What disqualifies you from a small business loan?

Getting a business loan is one of the best ways to get cash to cover short-term needs or accelerate your company’s growth. But not every business will be eligible for a loan. Lenders have a lot of requirements for companies that want to borrow money and you might find it difficult to qualify.

Here’s a look at some of the things that could disqualify you from getting a small business loan.

Ineligible businesses

Some lenders will not lend to companies that operate in certain industries. Some industries are high-risk, so some banks won’t lend to companies in real estate, sales, or investing. Other common disqualifying industries include gambling, adult entertainment, dispensaries and cryptocurrency.

Poor credit history

Lenders will check your personal and business credit reports to assess your creditworthiness. Business owners with bad credit will have a hard time qualifying for a small business loan. Many lenders, especially traditional banks, prefer to avoid taking on the risk of lending to someone with poor credit.

Alternative online lenders are more likely to offer bad credit business loans, but depending on the type of loan, you’ll likely need a FICO personal credit score of 550 or higher to qualify. And if you are approved, these loans typically come with high interest and costly loan fees.

Limited cash on hand

When you apply for a business loan, the lender expects to see a copy of your business financial reports, including cash flow and bank statements. The lender wants to ensure your company can support payments on a new loan.

If you have almost no cash in the bank, that represents a risk, as it can look like you’re applying for a loan out of desperation. If your company doesn’t have money in the bank and an appearance of stability, you’ll have trouble getting a loan.

No profits

If your company is losing money, you’ll unlikely be able to afford payments on a new loan. Lenders will want to see sufficient revenue and profits to cover payments on the new loan.

Too much debt

If you already have debt, some lenders might be unwilling to offer a loan to your company. This is especially true if you have a significant amount of debt. Lenders primarily care about whether you’ll repay the loan. If most of your revenue is tied up paying other loans, you won’t have enough money to pay the new loan.

No business collateral

Secured loans are common in the world of business lending, especially if your company has a limited credit history or poor credit. If your company doesn’t have enough assets to offer as business collateral to secure loan, lenders may not approve your application.

Unsecured loans may be an option, but if you don’t have good or excellent credit, you may have to settle for certain unsecured loans with higher interest rates and fees. This includes options like lines of credit with shorter repayment periods and merchant cash advances.

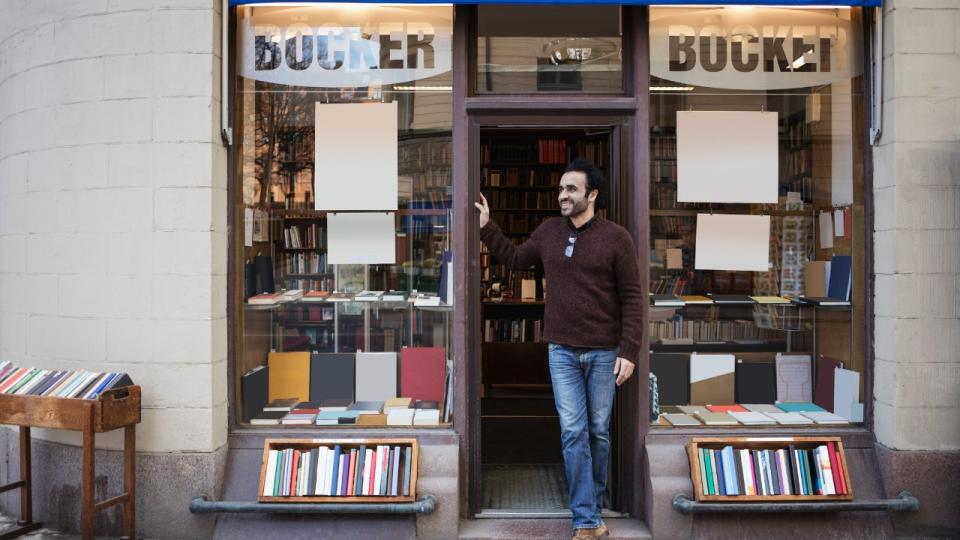

Poorly developed business plan

Some lenders will want to see your business plan before deciding. This is common if your company is relatively new and you plan to use the loan proceeds to get your operations off the ground.

If you have a strong business plan with a clear path that starts with getting a loan and ends with having a profitable company that repays its debts, that can help you get approved. Lenders will be less willing to lend to you if you lack direction or have an unfocused or unclear plan.

Applying for the wrong type of loan

There are many different types of business loans out there, each with a different purpose. If you apply for the wrong one, you’re unlikely to get approved.

For example, many lenders let you apply for an equipment loan to secure semi-truck financing. But if you apply with a lender that doesn’t allow you to use that type of loan to purchase commercial vehicles, you’ll be denied.

Alternatives to small business loans

There are many alternatives to small business loans. If you’re not sure a loan is right for you or if you have trouble qualifying, consider these alternatives to business loans.

Business credit cards

Business credit cards are popular for a number of reasons.

They make it easy to finance small everyday purchases for a short period of time. You don’t even have to pay interest if you pay the card balance in full.

Credit cards also offer valuable perks, including fraud protection and rewards. Many business cards also offer cash back that can help you save money or travel benefits that you can use the next time you go on a trip.

Business grants

Grants are a source of funds you don’t have to pay back. It’s a highly competitive process, but it can be a great source of cash for your company.

Many governmental and nonprofit organizations offer business grants. Some focus on specific industries, while others focus on specific regions or cities. There are also grants aimed at specific business owner demographics, including:

Crowdfunding

Crowdfunding is a way to raise money from everyday people. The idea is that you can raise small amounts from many people.

Crowdfunding is a popular way to pre-sell products, get paid upfront, and use that money to produce the goods you ship to customers. Community-based businesses might also use crowdfunding to get money from customers who want to see them succeed.

Peer-to-peer lending

Peer-to-peer lending relies on regular people investing in a loan to your business. Each investor only puts in a small amount of money. Spreading the risk out in that way means peer-to-peer lending is still an option when traditional lending isn’t.

One drawback is that peer-to-peer lending may have higher rates and fees than some business loans. It can also take a while for investors to fund your loan, making it a poor choice for companies that need quick cash.

Bootstrapping

Bootstrapping refers to funding your business yourself. There are three stages of bootstrapping:

-

Beginner stage. You put your own money into the company or get cash from friends and family. You then try to build the company from scratch, often while keeping your full-time job.

-

Customer-funded. This stage relies on the revenues you receive from customers to keep the company running and growing.

-

Credit stage. This stage involves focusing on specific goals, like hiring staff, buying new tools, upgrading equipment, and using venture capital loans to finance those goals.

Bottom line

Getting a business loan can help your company grow, but it isn’t the only option available. If your company is disqualified from getting a loan, consider alternatives like crowdfunding or business grants to get the cash that you need.

Frequently asked questions

-

Why would a business not be SBA approved?

The SBA has a list of requirements that companies must meet. To be eligible, a company must:

-

Operate for profit

-

Be based in the U.S. or its territories or engaged in business there

-

Have reasonable owner equity to invest

-

Use alternative financial resources, including personal assets, before seeking financial assistance

For example, a non-profit organization or a business where the owner hasn’t invested any personal funds would be ineligible. Other factors, like having insufficient credit or being in an unapproved industry, could also lead to a loan denial.

-

-

Why is it so hard to get a business loan?

Getting a business loan is hard because lenders are risk-averse. They don’t want to give money to businesses that might run into hard times and default on a loan. This is especially true when there is a threat of an economic slowdown.Lenders prefer to lend to established companies with a track record of profitability and proper loan management.

-

How can I increase my chances of qualifying for a business loan?

Some ways of increasing your chances of getting a business loan include:

[sc code=”alpine_collapse”]