Khosla Ventures Closes In on $3 Billion for Venture Funds, Defying Startup Slump

Khosla Ventures is in the final stages of raising $3 billion for its latest set of venture funds, showing how some Silicon Valley investors remain bullish even as startups continue to stare down slower growth and lower valuations.

The fundraise will be one of the largest completed by a venture firm this year and one of the few to grow in size. Khosla Ventures last raised $1.85 billion three years ago.

The firm said it would focus on backing startups in research-intensive sectors such as nuclear fusion and humanoid robots. One investment area will be artificial intelligence, which has been an area of recent excitement in Silicon Valley even though many of the benefits have so far flowed to the tech giants.

Khosla Ventures sees the less competitive market as an opportunity to back startups aiming to bring technological changes to legacy industries such as healthcare and transportation. The firm in 2019 invested $50 million in OpenAI, the creator of ChatGPT, making it the first outside investor in the company. That investment was more than double the largest first check Khosla Ventures had ever written for a startup.

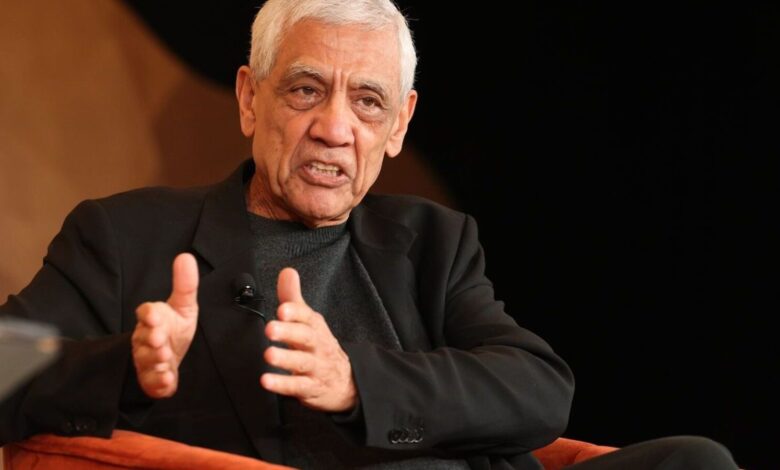

“There are fundamentally large, socially transformative areas to go after with higher risk investments,” said Vinod Khosla, the firm’s 68-year-old founder, who also helped start Sun Microsystems, an influential computing firm that was acquired by Oracle in 2010.

The high-interest-rate environment of the past two years has led investors to cut back on funding for startups after years of breakneck expansion. Earlier this year, Founders Fund and Sequoia Capital cut back the sizes of existing funds, while other venture giants such as Tiger Global Management have slashed their fundraising goals for future funds.

Founded 19 years ago, Khosla Ventures has invested in software giants like DoorDash and Block, as well as more research-intensive startups in sectors like sustainability and healthcare. It has also backed Spiritus, a direct carbon air-capture startup, and Hermeus, a developer of hypersonic aircraft.

Khosla Ventures will raise $500 million for a seed fund that will back startups at their inception, as well as a $1.6 billion venture fund for startups that have progressed past the seed stage but are still young. Both funds are larger than their predecessors, which came in at $300 million and $1 billion, respectively. The firm said it expects to conclude its fundraise by the end of the year.

Khosla Ventures is also raising a $900 million growth fund to back larger startups, up from $550 million from its last fundraise. Many of Khosla’s rivals have shrunk the size of similar funds given the market contraction.

“This is not your typical software investing,” said Larry Cohen, the chief executive of Gates Ventures, the family office of Bill Gates. “The time horizons are super long.” Cohen said that Gates Ventures has invested in Khosla Ventures for more than 10 years and that its financial performance has been “among the strongest” for venture capital funds.

Some of Khosla’s more far-flung bets have been punished by the market. For example, lithium battery maker QuantumScape has seen its shares lose more than 90% of their value from a record high in late 2020. LanzaTech Global, a carbon-capture company, has also seen its stock slide since merging with a special-purpose acquisition company earlier this year. Khosla Ventures is in the black on both investments, however, because of how early it invested in those companies.

“If you’re investing today, I’m expecting to be looking at liquidity in 2030,” Khosla said. “These are humongous markets if successful.”

Write to Berber Jin at berber.jin@wsj.com

Milestone Alert!Livemint tops charts as the fastest growing news website in the world 🌏 Click here to know more.