IP and Startup Financing – Lexology

New joint EPO/EUIPO report looks at the impact of intellectual property rights on startups’ success in securing funding

Recently, the European Patent Office (EPO) and the European Union Intellectual Property Office (EUIPO) published a new joint study looking at the relationship between intellectual property rights (IRPs), specifically patents and trade marks, and access to funding for startups in Europe. In this article we look at the report’s headline findings, and some of the interesting details revealed by the report’s analysis.

The report set the scene with a review of the literature available on the significance of intellectual property rights (IPRs) to startups, and summarised some of the main reasons why startups should secure IPRs. Some of the reasons it highlighted include:

- The monopoly conferred by patents can reduce competitive pressures (improving the profitability of the startup and securing higher returns for investors).

- Patent filings are effective indicators of the technical capabilities of firms and their employees.

- Trade mark applications demonstrate that startups are aware of the importance of marketing protection.

- Patents and trade marks will survive as assets in the event of a bankruptcy, providing security for both investors and lenders.

- Licensing patents can provide additional income.

- Patent rights can help enable startups to enter joint research ventures with larger firms, accelerating their own research and development.

- Startups’ intellectual assets typically greatly outweigh their physical assets, and investing early in securing registered rights can send an important signal to potential investors of otherwise unobservable value in a startup.

The report sought to put hard figures on the correlation between the act of applying for IPRs and the success startups find in securing funding and, ultimately, achieving a successful exit for investors through acquisition or IPO. To do this, the report aggregated demographic and financial information on startups from the website Crunchbase, a commercial database that provides data on startups including information about startups’ funding and subsequent public listings or acquisitions. The report considered startups founded since 1999 and with a registered office in a member state of the EPO. IPR status was measured by patents applications at both national offices and at the EPO, and by applications for national and EU trade marks.

The data on IPR applications was combined with data on startup financing at three different funding stages:

- Seed stage

- Early stage (Series A or B funding rounds)

- Late stage (Series C and beyond)

The report also looked at the link between IPR applications and a successful exit for investors, defined as an IPO or acquisition.

The report sets out a number of striking results.

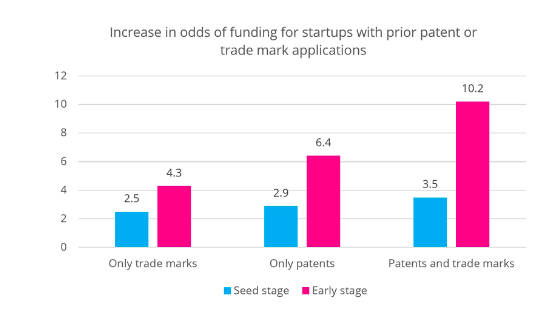

The headline results of the report are that, on average 29% of European startups have filed for registered IP rights. The report also found that on average, startups that have applied for both patents and trade marks during their initial seed or early growth stages are up to 10.2 times more likely to successfully secure funding compared to startups with no IPRs.

Beyond the headline results, however, there are some fascinating details within the numbers presented in the report.

At all funding stages, startups with IPRs secured greater funding on average than those without. However, the report noted that there were significant differences among sectors and funding rounds. For this reason the report applied an econometric analysis of the impact of prior IPR use on the likelihood of funding, while controlling for relevant factors such as the country in which the startup is based and the sector in which it operates. Using this approach, the report provided figures for the relative likelihood of startups securing funding at different stages, depending on whether or not they had applied for IPRs.

The report found that filing of patent and trade mark applications in the seed or early growth stage is associated with a higher likelihood of subsequent funding. This effect was particularly important in the early stage, with a 4.3 times higher likelihood of funding for startups that filed for trade marks, and a 6.4 times higher likelihood of funding for startups that filed for patents. Startups that filed for both trade marks and patents showed the highest likelihood of funding in both the seed and the early stage.

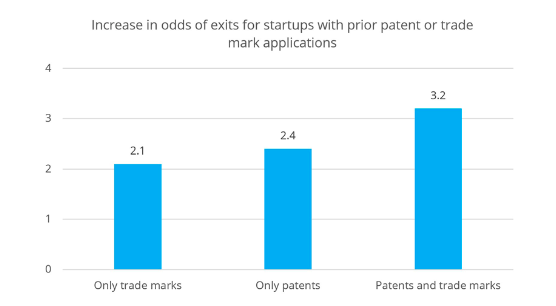

There was a similar picture when it came to successful exits, with the filing of patent and/or trade mark applications associated with a more than twice as high likelihood of successful exit for investors. The highest likelihood of initial public offering (IPO) or acquisition was seen in startups that filed for both patents and trade marks.

These figures demonstrate that IPR applications are associated with an increased likelihood in a startup securing funding, and an increased likelihood of investors realising a successful exit through IPO or acquisition. Notably, the effect was most strongly seen in startups which applied for both patents and trade marks, suggesting that the startups which pursue a holistic approach to their IP (rather than focusing on one particular type of intellectual property right) are those which can best attract funding and achieve a successful exit.

The report noted a significant variation in different sectors. Biotechnology was the sector most strongly correlated with IPR activity, with nearly half of all startups using either patents or registered trade marks. Other IP-intensive sectors noted in the report include science and engineering (with 25% of startups using patents and 38% of startups using trade marks), and the healthcare sector (20% of startups using patents and 40% of startups using trade marks).

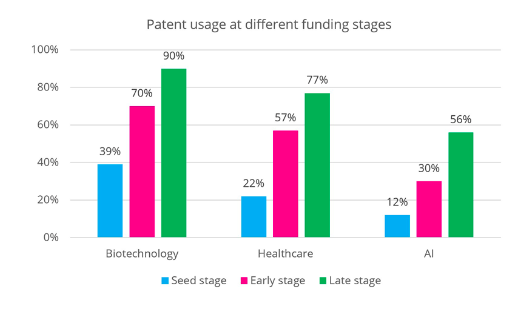

In an annex to the report, data was presented on the share of IPR usage at different stages of financing, broken down by sector, and this revealed some interesting variations between sectors on the impact of IPR usage. The following graphs compare the IPR usage at different funding stages for startups in the Biotechnology, Healthcare, and Artificial Intelligence sectors:

For Biotechnology startups, 39% of companies had applied for patents at the seed stage, with this proportion increasing by a factor of 2.3 to 90% for those successfully achieving late stage funding. In the Healthcare sector, on the other hand, 22% of companies had applied for patents at the seed stage, with this proportion increasing by a factor of 3.5 to 77% for those at the late stage.

The difference between seed and late stage is particularly marked in Artificial Intelligence (AI): in the AI sector, just 12% of startups use patents at the seed stage, but the proportion increases by a factor of 4.7 to 56%.

These numbers indicate that, although the overall proportion of patent usage in the Healthcare and AI sectors is lower than in biotechnology, it appears that having IPRs (and patents in particular) has a greater impact in allowing companies to secure funding over their competitors.

The results provide much food for thought for startups and investors alike, and our observations are:

- Startups which secure IPRs at early growth stages are more likely to secure funding and provide a successful exit for their investors. This highlights the importance of putting in place strategies to secure IPRs at an early stage.

- Across the board, the best outcomes were observed for startups which engaged with both patents and trade marks. This suggests that a holistic approach to IP yields gains for startups.

- For some sectors, such as Biotechnology, a near majority of startups have secured patents at an early stage. In other sectors, such as AI and Healthcare, whilst the proportion of startups holding patents is lower at the seed stage, there is a greater change in the proportion of companies holding patents between the seed stage and late stage funding stage. This suggests that for some sectors, patent-holding companies can have a real advantage over their competitors in securing funding.

Overall, the report confirms that intellectual property rights are vital for startups looking to secure funding, and an important signal for investors trying to ensure a return on their investment. Startups should keep this in mind and engage with intellectual property rights at an early stage.