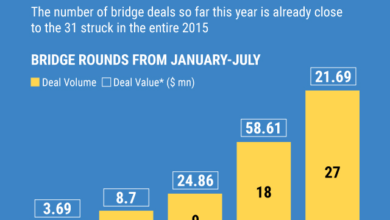

Startups feel the squeeze in Q3

It has been a tough year for startups. The collapse of Silicon Valley Bank sent shock waves throughout the venture landscape, the IPO window remains shut for most VC-backed companies, and some investors are backing away from market participation altogether.

Startups are facing a squeeze amid the friendliest investor environment in years, according to the latest PitchBook-NVCA Venture Monitor. The availability of capital (or lack thereof) has forced startups to operate on investors’ terms. While there are some signs of relief on the horizon, these five charts underscore the steep road ahead.

Since 2022, the PitchBook VC Dealmaking Indicator has snapped sharply back toward an investor’s market. The indicator quantifies how startup- or investor-friendly the capital-raising environment is.

The shift in momentum has been largely driven by startups that are starved for capital amid funding scarcity.

“The current fundraising environment is very competitive right now,” said Sean Kelly, CEO of Amperon, an AI energy analytics startup that just closed its $20 million Series B. “Investors are placing increased scrutiny on metrics.”

Nontraditional investors are quickly fleeing the venture landscape, cutting off a key source of funding for startups. Participation rates are down across the board for this investor type.

Corporate venture capital firms, some of the most prolific nontraditional investors, have participated in 24.1% of all US VC deals in 2023, down from a high of 27% in 2021. Private equity firms, which traditionally had only ever dipped their toes into VC investing, also left the sector quickly.

Nontraditional investors have primarily been beset by a closed-off exit environment—the ongoing IPO freeze—that in turn is generating less returns for portfolios across the spectrum.

But nontraditional investors, particularly corporations, are not entirely absent. Amazon, Nvidia and Alphabet have all recently made big investments in generative AI startups, with Amazon pledging $4 billion to large language model provider Anthropic. But these deals are outliers.

There are an estimated 75 startups in PitchBook’s IPO backlog, highlighting the poor exit environment plaguing so many VC-backed startups.

And the outlook remains somewhat mixed: While Instacart, Arm and Klaviyo all went public, interest rates are likely to stay high for a while, depressing the public markets and frightening new entrants.

Without this critical off-ramp, later-stage startups have been forced to burn more cash, raise more down rounds and ultimately ask for more capital than is available.

Insider-led deals—in which existing investors lead new funding into a company—are on the rise, now up to nearly their highest point since 2013 and sending another mixed signal about the current environment. Startups are struggling to raise and are having to go back to the same investors. Combined with the less friendly dealmaking environment, startups are feeling the squeeze.

“After receiving a term sheet with a 3x liquidation preference, I knew my time was better spent finding financing elsewhere,” said Eliza Bank, CEO of direct-to-consumer plant business The Sill, who recently turned to equity crowdfunding.

For many startups asking for cash, the supply simply isn’t there. The ratio of capital demand to supply has skyrocketed to its highest level in over a decade for later-stage startups. For early-stage and venture growth companies, the demand has evened out, though it remains elevated. Many startups that raised at the height of 2021 are facing the end of their runways, forcing some to raise down rounds while others lay off employees and restructure.

“We are definitely seeing a lot more companies that got caught in a bad position with runway relative to traction or at huge valuations,” said Nick Adams, managing partner of Differential Ventures. “They’re out raising capital to recap the company or just stay alive a while long.”

Featured image by Yulia Reznikov/Getty Images

This article originally appeared on PitchBook News