How Grants Work: A Complete Beginner’s Guide

Small business grants provide a major financial boost, but they’re highly competitive and not that easy to find. Learn what you need to know to get free money to build your small business.

Grants are given by governments, government agencies, nonprofit organizations, businesses, and other organizations in order to serve the public good. This can involve many goals, including:

- Spurring technological innovation

- Creating jobs and economic growth

- Driving social equity

- Enhancing public health

- Providing disaster relief

- Supporting environmental sustainability

Small businesses contribute to these goals in big ways. The U.S. Small Business Administration (SBA) has noted that small businesses create nearly two out of three new jobs and drive 44% of the U.S. economy.

The National Center for Science and Engineering Statistics (NCSES) further reports that among companies doing research and development (R&D), “small and young firms are more innovative, more productive R&D performers, and perform research that is more radical.”

So does your small business qualify for grant funds? What kinds of startup grants are out there, and how can you compete for them? This guide will help you set up a plan for adding grant- seeking to your company’s financial strategy.

Overview: What is a grant?

A grant is cash or an item with cash value given to a business or other organization. Unlike loans, grants do not have to be repaid.

Grants for business are relatively rare and highly competitive. For this reason, they’re not a primary source of income. Rather, they are cash infusions that can speed growth, enhance financial strength, and fund special initiatives.

5 types of grants small businesses can get

How do you find small business grants? If you run a quick online search, you’ll find a plethora of databases and articles on grant opportunities. Filter them down to viable grant opportunities for businesses, however, and the list grows surprisingly short.

Basically, business grants fall into these five categories:

Federal grants

The federal government runs two ongoing grant programs for small businesses through the SBA. They are:

- Small Business Innovation Research (SBIR): SBIR awards grants to small businesses doing research solicited by 12 federal agencies. The agencies publish solicitations throughout the year, and small businesses must submit proposals to apply.

- Small Business Technology Transfer (STTR): STTR grants are awarded to small businesses working with nonprofit partners, such as universities, on research projects. Five federal agencies participate in STTR.

SBIR and STTR are unusual because they award grant money directly to businesses. Most federal grant funds for business are awarded to governments, government agencies, nonprofits, and other organizations, which then support businesses. At the federal level, direct support to businesses usually takes one of these forms:

- Low-interest loans, sometimes with loan forgiveness

- Tax credits

- Government contract set-asides

- Coaching, mentoring, and financial counseling

- Technical assistance

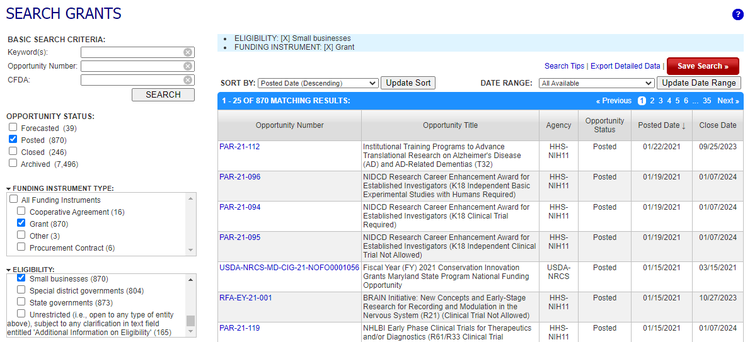

Grants open to small businesses are listed in the federal grants database at grants.gov. But, as the website notes, the database is for “organizations and entities supporting the development and management of government programs and projects.” It’s not a source for “financial assistance opportunities.”

That said, there are 909 grants on the site open to small businesses either directly or indirectly. Of those, 84% are research grants.

More than 900 federal grants are open to small businesses on grants.gov, but it’s not a source for general business grants. Image source: Author

An example of a federal grant with a direct cash award is a listing for Natural Resources Conservation Service grants of up to $75,000 for Maryland organizations (including businesses) that are adopting or developing innovative conservation solutions.

Basically, if you’re doing research, supporting or partnering with government agencies, or creating a substantial public benefit, it’s worth a federal grants database search.

State grants

State grants are often more liberal and less competitive than federal ones. You’re more likely to find cash awards for business development and job creation through state authorities than with federal grant systems.

The best way to find these state grants is not to search online. Instead, reach out directly to your state business development office.

If you’re serious about getting state grant money, put your state’s business development office on speed dial. Image source: Author

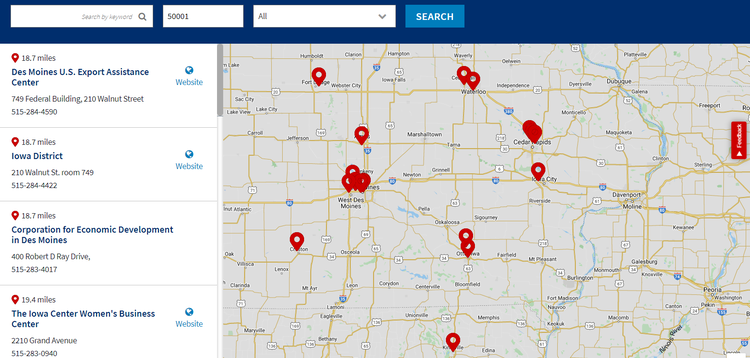

You’ll also want to stay in touch with your local SBA small business development center. They will know what kinds of SBA grants and other opportunities you might qualify for and how you can approach them effectively.

A quick online search will connect you with your local SBA representatives, who are a prime source of grant information. Image source: Author

County and city grants

Your county and municipal governments are also key resources for small business grants. Once again, you’re more likely to find cash grants at this level, and you don’t have to conduct grant research on your own. Call your local business development office and ask about grants. With a single call, you can describe your business and find out if there are any promising programs open to you.

Here’s an example.

In May 2020, Charlotte, North Carolina, allocated $35 million of $154.5 million in federal COVID-19 relief funds for small business assistance. The city decided to award grants of up to $25,000 apiece for small businesses with six to 25 employees and up to $10,000 apiece for smaller companies to spend on expenses resulting from the pandemic.

That’s relief you can’t afford to miss out on. And you probably won’t miss out if you have relationships with your business development reps and you’re on your city’s business development mailing list.

Company grants

Many companies award grants to small businesses as a way of giving back and stimulating development in line with their missions. Examples include the FedEx Small Business Grant program, which awards grants of up to $50,000 to innovative businesses, and the Cartier Women’s Initiative, which provides grants of up to $100,000 to “women impact entrepreneurs leveraging business as a force for good.”

To find these opportunities, you have to search online. I would recommend searching quarterly since these initiatives come and go. Also check out The Ascent’s articles on grants for startups and women-owned businesses.

Organization grants

Many foundations and other nonprofit organizations award business grants. Some examples include the Amber Grant program, which awards $10,000 in grants to women entrepreneurs each month and a yearly prize of $25,000, and Growth Grants from the National Association for the Self-Employed (NASE), which are open to the association’s members.

Adriana Luna Diaz, the creator of Tierra de Monte earth-friendly farming products, earned a $100,000 Cartier grant in 2020. Image source: Author

How to apply for a grant for your business

Searching may seem like the hardest part, but applying for a small business grant can be equally taxing. Here are six steps for completing a business grant application.

1. Beware of scams

While some grant applications require modest fees or membership in a group, anything beyond that could signal a grant scam. Beware of any solicitation that:

- Comes from an organization you’ve never heard of

- Approaches you unsolicited, even if it’s an organization you’ve heard of

- Asks you to match funds or pay money upfront

- Requests bank account numbers or other personal identifying information

According to the Federal Trade Commission (FTC), grant scams often take the form of a congratulatory email or letter saying you’ve won a free grant. Stop there and file it under “too good to be true.” Also, you might want to report it to the FTC or call 1-877-FTC-HELP.

2. Find your hook

For both the search and your application, it helps to consider your business’s unique hook. What aspect of the public good does your business serve? Is your business majority-owned by a woman, person of color, veteran, someone with a disability, or a member of any historically disadvantaged group? Is your business going green, working on novel technology, or helping your community? Are you working in an economically depressed industry or area?

If you don’t have a unique angle, don’t worry. You’re still a small business creating jobs and economic activity in your community, and that opens up opportunities as well.

3. Confirm your eligibility

Before you get into the weeds on any grant solicitation, thoroughly read all the eligibility requirements. Unfortunately, key details are often tucked away in the fine print. You don’t want to waste time reading about an interesting opportunity only to find out that you don’t qualify.

4. Tell your story

For many grant applications, it helps to have a compelling story about what makes your business unique. This goes beyond your mission statement to describe your company’s journey from inspiration to realization.

To create a compelling company story, consider:

- What was the need that sparked the idea for your business?

- What personal desires drove you to form the business?

- What challenges have you overcome?

- What drives you through hard times?

- What change do you hope your business will make in the world?

- What separates you from your competition?

Your story should adapt to fit the specific grant specifications, but it will always be a variation on the central theme of your business’s unique journey.

5. Follow the specifications precisely

Writing a grant proposal can be a time-consuming and meticulous task. Some proposals require detailed financial accounting and extensive documentation. Whatever they require, it’s critical to provide exactly what they ask for in the order and format they request. All grants are highly competitive, and you don’t want to be disqualified over a missing document.

6. Have someone review your submission

Ask your contacts at the SBA or your business development office to look over your proposal before you submit it. They understand that grant applications can be complex, and, in most cases, they have staff people who can help you work through a particularly challenging application.

Often they know what the grantmakers are looking for. Take advantage of their expertise to save yourself valuable time and increase your chances of getting funding.

Jessie’s Nutty Cups won a $15,000 FedEx grant to expand the business. Image source: Author