7 Best Startup Grants That You Can Apply for Today

Startup grants give your business a huge financial leg up. But finding and winning them can be a challenge. Our quick guide will help you find the best grant opportunities for your business.

Two out of three small businesses face financial challenges, and more than half tap their personal savings, friends, or family for startup funds. That can limit your business’s potential — and your personal potential, too.

New business grants are an instant financial boost because, unlike seed funding, they provide cash without leveraging anything in return. The only real downside is the time it takes to find suitable opportunities and apply.

Unfortunately, that time can be substantial. For every business startup grant you find online, you’ll have to wade through a sea of grants reserved for nonprofits, government agencies, and businesses in hyper-specific markets or fields.

And, often, you have to read down into the fine print to discover that the grant opportunity you’re so excited about is only for wind-powered organic food packagers in DuBois. With so many mismatches and dead ends to chase down, you might be forgiven for giving up on grants entirely.

This guide will help you save time and frustration by pointing you to evergreen, reliable sources of startup business grants. It also provides tips for conducting an efficient quarterly grant search.

All of the grant opportunities listed here provide cash awards to startups and small businesses. They do not include awards such as contract set-asides provided by the U.S. Small Business Administration (SBA) and other government agencies.

Overview: What are startup grants?

Startup grants are gifts of cash or items with cash value awarded to businesses in the early phases of growth. Unlike loans, grants do not have to be repaid. And, unlike funds from private equity and venture capital investors, grants are a non-dilutive funding source, meaning they do not require you to relinquish any equity in the company, and they do not reduce the value of your business.

Here are some tips for finding viable grant opportunities for your small business.

More than half of small businesses rely on friends, family, or personal savings to get through lean times. Image source: Author

Common eligibility criteria for startup grants

What can you expect when you apply for a grant? Applications range from quick online questionnaires asking for your company’s story to full-fledged grant proposals with detailed plans and budget projections. Here are some of the common criteria grantmakers evaluate when selecting small businesses to fund.

Size and age

Grants for startups often specify a size or age range for your business. For example, a grant might be limited to businesses less than two years old, or with revenue of less than $1 million. Size may also be expressed by employee count.

Location

Many grants for new businesses are targeted to a specific market or geographic area. Some require you to have facilities within a certain area, while others may rely on your state of formation.

Ownership

Ownership of your company is a key element in many grant applications. Some grants are reserved for businesses owned by women, minorities, veterans, or other underserved populations. Others may require ownership by individuals as opposed to companies or trusts.

Finances

Grantmakers want to know their money will be well spent. As a result, many grant applications require detailed financial information on your business. Some awards are based on financial need, while others may require evidence of your business’s financial strength and viability to ensure that the grant funds will have enduring impact.

Innovation

Small business grants are often based on the innovation and market potential of your idea, product, service, or approach. You might need to provide a competitive analysis showing what is unique or compelling about your business or a market analysis quantifying the need or audience for your offerings.

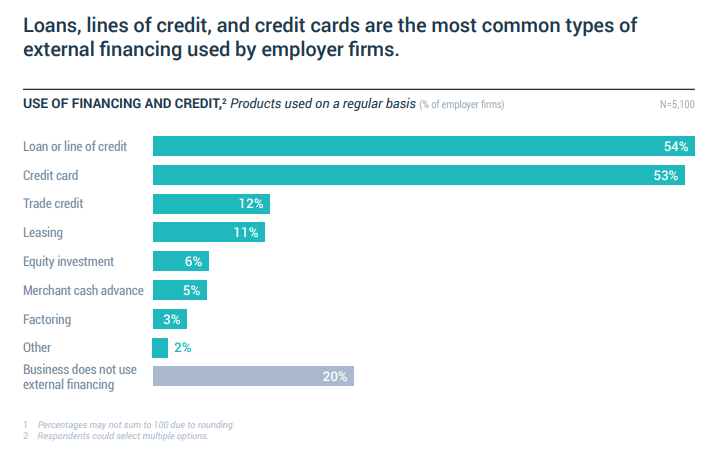

Many small businesses turn to loans and credit cards to fund operations. Image source: Author

Public good

Many grants are designed to promote a social benefit. If your business has a mission that serves the public good, you may find grant opportunities specifically for that purpose. For example, if your mission includes reducing waste, you should look for grants for businesses with environmental impact.

Advantages of using a startup grant vs. other funding options

Here are some of the key benefits of grants over other funding sources.

Instant cash boost

Grants are the proverbial free lunch of business finances. Unlike loans and seed money, grants are an immediate infusion of cash into your business with no corresponding hit to your company’s assets or ownership. There is no richer funding source out there.

No repayment

Loans are a common and valuable funding source, but they usually have to be repaid with interest. The exception is loans with forgiveness, such as Payment Protection Program loans in response to the COVID-19 pandemic. But loan forgiveness is usually contingent on many factors, making it far from a sure thing.

Exposure

Many grantmakers are national and global brands eager to share the results of their award programs with the world. Grantees are often featured in social media, company websites, advertisements, email, and press releases. This publicity can be just as valuable to the small business as the grant funds themselves.

Support

Many business startup grants include mentoring, training, and other support services for expanding your business. With complex grants, you may receive help with completing the application.

Security

Grants enhance your company’s financial security because they reduce your need to leverage company assets — or worse, personal assets — to fund growth.

A life-changing product earned Access Trax a $50,000 small business grant from FedEx. Image source: Author

Disadvantages of using a startup grant vs. other funding options

Grants also have downsides. Here are a few drawbacks to consider when looking at small business grants.

Timelines

Grants tend to move slowly. The application period usually spans several months to encourage widespread participation. Once you submit, you’re often looking at several more months before a decision is made and possibly waiting even longer before receiving the award.

Uncertainty

Competition for small business grants is tight. The FedEx Small Business Grant, for example, drew 4,000 applications in 2020 and made 12 awards. That places your odds at about one-third of 1%. Basically, grants are like financial icing. It’s awesome, but it’s not something you can live on.

Application requirements

Probably the biggest drawback to grants is that they take so much time to research and apply for. This is especially true if you don’t have a systematic way to manage the searching and vetting process.

7 best startup grants that you can apply for today

Here are seven grants you can apply for annually.

1. FedEx Small Business Grant

Each year, FedEx awards a dozen grants totaling more than $250,000 to small businesses, including startups. The awards range from $15,000 to $50,000, plus free FedEx business services. The application period opens around February of each year. Check the FedEx Small Business Grant website for the next award period. You can see past winners there, too.

2. Small Business Innovation Research (SBIR) Grant

Each year, 12 federal agencies set aside a minimum of $3.2 billion for SBIR grants to fund research and development (R&D) to support their missions. The program provides grants ranging from $50,000 to $750,000 for up to two years.

Participating agencies publish detailed solicitations for projects to support their initiatives. To apply, you must search the SBIR database for an appropriate funding opportunity and submit a proposal in response.

3. Small Business Technology Transfer (STTR) Grant

STTR grants are awarded to small businesses conducting R&D in partnership with a nonprofit research institution such as a university. STTR grants are awarded by five federal agencies: the Department of Defense (DOD), Department of Education (ED), Department of Health and Human Services (HHS), National Aeronautics and Space Administration (NASA), and National Science Foundation (NSF).

To apply, search the SBIR/STTR database to find a matching opportunity and submit a proposal.

4. National Association for the Self-Employed (NASE) Growth Grants

The NASE awards Growth Grants of up to $4,000 to members who are self-employed or leading microbusinesses. The grants provide funds for training, marketing, investing in hardware and software, and other growth enablers. The organization has awarded nearly $1 million in startup grants since 2006. New awards are given every quarter. To apply, you must be a member or join NASE.

5. Local and state business development grants

Many business grants are awarded by local and state governments to drive development. These awards can be easier to get because they are local. The best way to find them is to contact your local and state business development offices and ask about any funds you might qualify for. Also check with your SBA district office. All of these agencies are there to help you, but you have to reach out and ask.

State and local business development offices are a prime resource for finding grants. Image source: Author

6. Grants for minority-, women-, and veteran-owned businesses

If your business is majority-owned by a woman, veteran, disabled person, person of color, or a member of another historically disadvantaged group, you qualify for a whole new set of opportunities.

One example is the StreetShares Foundation’s Veteran Small Business Award, which provides cash grants of varying amounts to veteran entrepreneurs. Another is the Back Black Businesses initiative by American Express, the National Black Chamber of Commerce, and other partners. The program is awarding $5,000 to more than 280 Black-owned small businesses each fall from 2020 to 2023.

Ask your SBA and development office representatives about grants set aside for you. And be sure to check out our article on grants for women-owned businesses.

It’s pretty hard to beat a pure cash award, especially when it comes with a giant check. Image source: Author

7. Caleb Brown Urban Excellence Community Grant

Caleb Brown Venture Capital provides a monthly $1,000 Community Grant to young urban entrepreneurs providing training and jobs in city communities and neighborhoods. The grants also provide 500 hours of complimentary business consulting services.

Best practices for finding good grant opportunities

You can stay on top of new grant opportunities without spending endless hours combing through databases and websites. Just follow these simple steps.

- Reach out to your city, county, and state business development reps: Use every resource out there to cut your research time and ferret out the best opportunities. Your tax dollars fund these services, so take full advantage of them.

- Consider any niches that fit: Don’t overlook special attributes such as minority status that might qualify your business for additional grants. You have to work harder every day to overcome hidden obstacles. If you can get a boost, take it.

- Create a grant database and calendar: You can search and apply for grants efficiently if you create a good system for them. Log the best opportunities in a database and calendar and appoint someone to apply each year.

- Search for new opportunities quarterly: Reach out to those contacts at state agencies and the SBA throughout the year. Ask about any new grants you might qualify for. Then allot a couple of hours each quarter to search for new opportunities online.

By controlling the search and application process, you can compete for a few choice grants each year with minimal fuss and expense.

What all winners have in common

All grant winners have one thing in common: They applied. Give your business a chance to compete for some of that free cash flow and exposure, and don’t be discouraged if you don’t win right away. Every application is a fresh chance to take your business to new heights.