Business ownership among persons with disabilities in Canada

Release date: January 18, 2022

DOI: https://doi.org/10.25318/36280001202101200004-eng

Skip to text

Text begins

Abstract

This paper provides a sociodemographic profile of business

owners with disabilities using 2017 administrative tax data. It evaluates how

sociodemographic characteristics of business owners with disabilities intersect

and compares them with those of business owners without disabilities. It also

examines the firm-level measures of these businesses, including firm size,

industry, exports and financial characteristics.

Authors

Amélie Lafrance-Cooke and Robby Bemrose are with the

Economic Analysis Division at Statistics Canada.

Acknowledgements

This study was funded by Women and Gender Equality Canada.

The authors would like to thank Danny Leung, Lyming Huang, April Doreleyers,

Marysa Vachon, Julie Burns, Nicole Yaansah, Sarah Jane Ferguson, Patrice

Rivard, Winnie Chan and Haleigh Prevost for their helpful comments.

Introduction

According to the 2017 Canadian Survey on Disability (CSD),

approximately 3.7 million Canadians aged 25 to 64 have a disability and,

as a result, are limited in their daily activities (Morris et al. 2018). While

about 65% of these working-age Canadians were also in the labour force, they

are disproportionately underrepresented in the labour force compared with persons

without disabilities (i.e., 85% of persons without disabilities are in the

labour force). Previous research has shown that persons with disabilities face

challenges and barriers in the labour market that can negatively impact their

earnings (Jones 2011; Lechner and Vazquez-Alvarez 20103 and increase their

likelihood of being in low-income groups (Wall 2017). The COVID-19 pandemic

further highlighted the vulnerability of this population, particularly in terms

of unique challenges that they may face, which intensified over the pandemic. These

include reliance on help outside the household for daily activities and the

likelihood of not having Internet access,Note which became an important asset to connect with others virtually and purchase

goods online.

A potential solution to low labour force participation

rates for persons with disabilities is self-employment or owning a business

(Kitching 2014). Entrepreneurship can offer an entry into the labour market,

which, in turn, can lead to improved income. It can provide more flexibility in

the pace of work and, potentially, a greater ability to work from home

(Kitching 2014).

According to the 2017 CSD, 8.6% of persons with

disabilities were self-employed in 2016, compared with 11.1% of persons without

disabilities. This contrasts slightly with evidence in the United States and in

Europe, where higher self-employment rates were found among persons with

disabilities (Kitching 2014). Nevertheless, such studies have found that

persons with disabilities face specific barriers to entrepreneurship, including

difficulties accessing capital and lack of appropriate and sensitive business

support or advice (Boylan and Burchardt 2002). New businesses created by

entrepreneurs with disabilities are less likely to become viable businessesNote (Renko, Harris and

Caldwell 2015).

There have been few Canadian studies on business owners

with disabilities, most likely because of the lack of available data on this

group of individuals. The Survey on Financing and Growth of Small and Medium

Enterprises (SFGSME) collects information on small and medium-sized enterprises

that are majority-owned by persons with disabilities, but this survey is

infrequent (i.e., every three years) and is limited in scope (e.g., there are

limits to intersectional analysis). Nevertheless, it offers a glimpse of the

profile of businesses that are majority-owned by persons with disabilities.

Data for 2017 show that a small proportion (0.5%) of small and medium

enterprises are majority-owned by persons with disabilities (Huang 2020). The

majority of these businesses have between one and fewer than four employees,

they tend to have sales growth between 1% and 10% per year, and a minority are

exporters. In addition, the owners of businesses majority-owned by persons with

disabilities tend to be young (younger than 49 years old), and they tend to

have a postsecondary education or higher.

More recently, the quarterly Canadian Survey on Business

Conditions has been collecting information to measure the impact of COVID-19 on

businesses, including businesses majority-owned by persons with disabilities.

While the survey cannot be used to examine the characteristics of businesses

majority-owned by persons with disabilities before the pandemic, it continues

to be an important contributor to the understanding of the effects of the

pandemic on diverse groups of businesses. Results from the first survey

undertaken in April 2020 suggest that businesses majority-owned by a person

with disabilities may have been more negatively impacted. For instance, 4.7% of

such businesses closed permanently, compared with 1.0% of businesses on

average. About one-half of businesses majority-owned by a person with

disabilities experienced a drop in revenue of more than 40% in early 2020

compared with the same period in 2019, relative to one-third of businesses on

average.

The lack of recurring and comprehensive data on business

ownership among persons with disabilities presents challenges in providing a

full picture of this group, which, in turn, is needed to design policies to

address barriers to business ownership. This paper attempts to fill this gap by

providing a sociodemographic profile of business owners with disabilities using

2017 administrative tax data. It evaluates how sociodemographic characteristics

of business owners with disabilities intersect and compares them with those of business

owners without disabilities. It also examines the firm-level measures of these

businesses. To the best of the authors’ knowledge, the administrative data have never been used for

this type of study in Canada.

Data and methods

The data used to generate the sociodemographic

characteristics of business owners with disabilities and the firm-level

measures of the businesses they own are from the Canadian Employer–Employee

Dynamics Database (CEEDD). This linkable employer–employee dataset is based on

processed administrative data sources from Statistics Canada; the Canada

Revenue Agency (CRA); Employment and Social Development Canada; and Immigration,

Refugees and Citizenship Canada (Chan, Liu and Morissette 2018). The key

variables used for this study are found in the T1 personal master file (T1PMF)

in the CEEDD, which includes information from form T2201 Disability Tax Credit

Certificate. The disability deduction claim is the variable used to identify

individuals with disabilities.Note

There were four main data processing steps in the

methodology. The first step entailed identifying persons with disabilities

within the population of individual tax filers, together with extracting the

associated sociodemographic and geographic variables. The second step involved

aggregating the individual ownership shares for a business from the reporting

units in the tax files to statistical units that correspond with the data

collected at the firm level (i.e., enterprise). The third step consisted of

linking the individuals with disabilities, along with their demographic

variables, to the shareholders of the private enterprises they own and

acquiring the associated firm-level measures. The fourth step involved deriving

the ownership share of each enterprise by gender, immigrant status and

disability status. Two approaches were used to identify the businesses owned by

persons with disabilities, as follows: (1) the business has one or more owners who

claim the disability tax credit (DTC), and (2) the business ownership share is

greater than or equal to 51% for owners who claim the DTC. The subsequent

sections describe the details of these processing steps.

Individual-level tax files

Persons with disabilities were identified in the

individual-level T1PMF data file (General Income Tax and Benefit Return) if

there was a claim made for either the DTC or the attendant care expenses

deduction in the 2017 tax year, both of which are discussed in more detail in

the next section. The T1PMF sociodemographic variables for this study are

largely limited to age, gender and income. The geographic variable, province or

territory of residence in the T1PMF, was also included. To obtain information

on the immigrant status, the CEEDD Longitudinal Immigration Database (IMDB)

file was linked to the T1PMF. The IMDB file contains immigration-related

information for foreign-born individuals who have become landed immigrants in

Canada since 1980 (Chan, Liu and Morissette 2018).

Enterprise-level ownership share

The business ownership share for incorporated businesses is

found in the CEEDD T2 Corporation Tax Return, Schedule 50 Shareholder

Information (T2S50) and for unincorporated businesses in the CEEDD T1 Financial

Declaration and Business Declaration (T1FDBD). The pre-processing steps applied

to generate the ownership share in these files can be found in a paper by Grekou,

Li and Liu (2018). With the shareholder data, the main objective is to

aggregate the percentage ownership shares to the enterprise-level statistical

unit. For the incorporated businesses, this is done by linking the T2S50 by the

Business Number (BN) to the National Accounts Longitudinal Microdata File

(NALMF). The NALMF is an enterprise-level database that includes all

enterprises that filed a Corporation Income Tax Return (T2), Statement of Remuneration

Paid (T4 slip) or payroll statement of account for source deductions (PD7)

(Grekou, Gu and Yan 2020). The NALMF provides the structure to link reporting

units in the administrative data (i.e., BN) to institutional units (i.e., enterprise).

Following the approach presented by Grekou, Li and Liu (2018), when the

enterprise consists of more than one BN, the ownership share is adjusted by

multiplying the individual ownership shares by the quotient of assets reported

at the BN and enterprise level. If the enterprise has only one associated BN,

the ownership share at the BN level is directly assigned to the enterprise. If

assets are missing, each individual is assigned an equal ownership share of the

enterprise. A similar approach is followed for the unincorporated businesses in

the T1FDBD, using methods found in the paper by Grekou, Li and Liu (2018).

Identifying the business owners and firm-level data

The business owners are identified by linking the

individual-level tax file (T1PMF) to the ownership share files of the

incorporated (T2S50) and unincorporated (T1FDBD) businesses. There are

3,052,951 individuals (including duplicates, because an individual could own

multiple businesses) in the T2 incorporated data; 2,927,428 were found in the

T1 file (≈ 96%). There are 1,359,427 individuals in the T1 unincorporated

data; 1,350,303 were found in the T1 file (≈ 99%). Business owners could

be missing from the individual tax returns because they did not submit their

taxes or they were late filing. The information could also have been entered

incorrectly in either of the tax files.

The NALMF firm-level data are linked to the incorporated

business ownership data by enterprise identifier to obtain the number of

employees,Note North American Industry Classification System industry, capital cost allowance,

net income, total assets, research and development (R&D) spending, total

revenue, and exports for each firm. The same variables for the unincorporated businesses

are already included in the T1FDBD file.Note

Ownership share by different subgroups

The firm-level ownership share is used to calculate the

portion of ownership for each category within the gender and immigrant status

variables. The individual ownership shares of the firm are summed by the

categories to determine the percentage amount of each category within the firm.

If the share of a category is greater than or equal to 51%, the class is labelled

as majority-owned. If the share between the categories is the same, there is

equal ownership. If there is no dominant category of ownership and the

categories do not sum to 100%, the firm is labelled as missing. As described by

Grekou, Li and Liu (2018), this can occur because only the shareholders with at

least 10% of the shares of a private corporation are reported in the T2S50, and

shareholders’ information can be misfiled or missing. The intersection of these

demographic dimensions of ownership is evaluated through cross tabulations.

Disability tax credit: What is it and how well does it capture the

population of persons with disabilities?

The DTC is a non-refundable tax credit that was introduced

in 1988 to allow persons with disabilities to reduce the amount of income tax

that they may have to pay. To be eligible for the DTC, an individual must

experience difficulties performing activities of daily living, such as walking,

speaking, feeding oneself or hearing, or other debilitating conditions that

affect day-to-day living.Note An individual applying for the DTC must have a medical practitioner fill out

form T2201 Disability Tax Credit Certificate, which certifies that the

individual has a severe and prolonged disability. If the individual’s medical

condition improves, they will no longer be eligible to receive the DTC. Persons

can claim the DTC for their spouse or dependants, but this article will focus

on individual claims.

In addition to the DTC, persons with disabilities can claim

attendant care expenses. These may be fees paid for full-time care in a nursing

home or salaries and wages of an attendant providing care within a person’s

home. In most cases, the DTC and attendant care expenses cannot both be

claimed. As a result, for the purposes of this paper, the number of persons

with disabilities also includes persons claiming attendant care expenses,

consisting of about 1,000 individuals who did not claim the DTC.

In 2017, about 841,000 Canadians aged 15Note and older claimed the DTC,

representing 3.0% of the total number of individuals who completed a tax

return, and 802,000 of these claimants were aged 25 and older, which is the age

group studied in this paper. This comparesNote with the 6.2 million Canadians aged 15 and older with disabilities based

on the 2017 CSD, of whom about 2.7 million had a severe or very severe

disability, limiting their daily activities. The considerably lower number of individuals

identified in the tax data is to be expected because individuals with

disabilities might not have enough taxable income to claim the DTC or might not

be in the labour force. In addition, some persons with disabilities may not be claiming

the DTC because they thought they did not meet the criteria, they did not know

that the tax credit existed or they were not able to obtain a completed

certificate (T2201) from their doctor (Duclos and Langlois 2003).

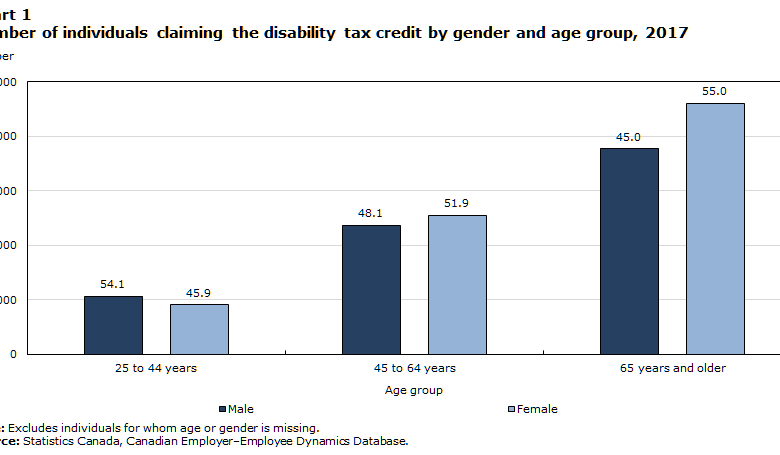

Among persons aged 25 and older, more than half (56.4%) of

individuals who claim the DTC are older than 65, 55% of whom are women (Chart

1). The share of women who claim the DTC increases with age; for persons aged

25 to 44, 54.1% of claimants are men. The gender distribution of persons

claiming the DTC is similar to the sex distribution in the CSD among

individuals aged 45 and older: 53.1% of persons with disabilities aged 45 to 64

are women, and 56.2% of persons with disabilities aged 65 and older are women.

In contrast, among the 25-to-44 age group, women represent 58.7% of persons

with disabilities based on the CSD.

Data table for Chart 1

| Age group | Male | Female | Male | Female |

|---|---|---|---|---|

| count | percent | |||

| 25 to 44 years | 53,104 | 45,144 | 54.1 | 45.9 |

| 45 to 64 years | 118,189 | 127,539 | 48.1 | 51.9 |

| 65 years and older | 188,497 | 230,000 | 45.0 | 55.0 |

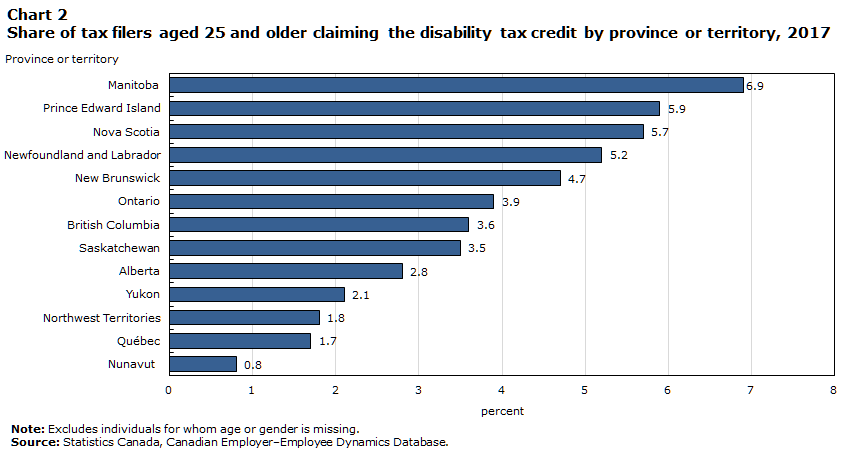

At the provincial and territorial level, a higher share of

individuals claimed the DTC in Manitoba (6.9%) and in the Atlantic provinces,

ranging from 4.7% in New Brunswick to 5.9% in Prince Edward Island (Chart 2).

Data table for Chart 2

| Province or territory | Percent |

|---|---|

| Manitoba | 6.9 |

| Prince Edward Island | 5.9 |

| Nova Scotia | 5.7 |

| Newfoundland and Labrador | 5.2 |

| New Brunswick | 4.7 |

| Ontario | 3.9 |

| British Columbia | 3.6 |

| Saskatchewan | 3.5 |

| Alberta | 2.8 |

| Yukon | 2.1 |

| Northwest Territories | 1.8 |

| Québec | 1.7 |

| Nunavut | 0.8 |

What is also noticeable from Chart 2 is the low share of

DTC claimants in Quebec compared with the other regions. Low shares of persons

with disabilities in Quebec have been presented in the literature (e.g.,

Dunstan 2003; Mackenzie 2013; Arim 2015). The low share of disability claims

could be a result of the Revenu Québec provincial disability tax credit, which

might be claimed instead of the federal DTC.

With the form T2201 Disability Tax Credit Certificate, it

is possible to determine the type and number of disabilities accepted by the

CRA for each individual who claims the tax credit, such as markedly restricted

mobility or walking, vision and speech. Nearly three-quarters (68.2%) of

individuals claiming the credit specify mobility or restricted walking as a

disability (Table 1). The second most common disability is mental functions

necessary for everyday life, which 39.1% of individuals specify on form T2201.

| Type of impairment | Number | Percentage of individuals claiming the DTCTable 1 Note 1 |

|---|---|---|

| Mobility | 573,679 | 68.20 |

| Mental function necessary for everyday life | 328,971 | 39.10 |

| Dressing | 226,398 | 26.90 |

| Eliminating | 111,436 | 13.30 |

| Feeding | 93,131 | 11.10 |

| Speech | 61,588 | 7.30 |

| Hearing | 61,487 | 7.30 |

| Life sustaining therapy | 55,635 | 6.60 |

| Vision | 53,186 | 6.30 |

| Other | 5,215 | 0.60 |

Results

Sociodemographic characteristics of business owners with disabilities

This section describes the type of disability and

sociodemographic characteristics (i.e., age, gender, immigrant status and

income) of the business owners with disabilities. Of the individuals that claim

the DTC, 1.3% (17,575) are shareholders of unincorporated businesses (T1FDBD)

and 1.2% (23,526) are shareholders of incorporated (T2S50) businesses.Note Note Results in this

section will be presented separately for the two types of businesses.

Business owners with disabilities tend to be older than business owners

without disabilities and a higher share are women

| Type of impairment | Unincorporated | Incorporated | ||

|---|---|---|---|---|

| number | percentage | number | percentage | |

| Mobility | 9,930 | 56.50 | 13,088 | 55.60 |

| Dressing | 3,589 | 20.40 | 5,026 | 21.40 |

| Mental function necessary for everyday life | 2,356 | 13.40 | 3,980 | 16.90 |

| Eliminating | 1,973 | 11.20 | 2,770 | 11.80 |

| Life sustaining therapy | 1,645 | 9.40 | 2,226 | 9.50 |

| Feeding | 1,302 | 7.40 | 1,993 | 8.50 |

| Hearing | 1,170 | 6.70 | 1,409 | 6.00 |

| Vision | 784 | 4.50 | 1,189 | 5.10 |

| Speech | 608 | 3.50 | 1,015 | 4.30 |

| Other | 14 | 0.10 | 21 | 0.10 |

The types of disability of the business owners are presented

in Table 2. The distribution of disabilities for business owners of both incorporated

and unincorporated businesses is similar. A mobility disability was reported by

more than half of business owners, as the most common disability, followed by

dressing and mental function disabilities.

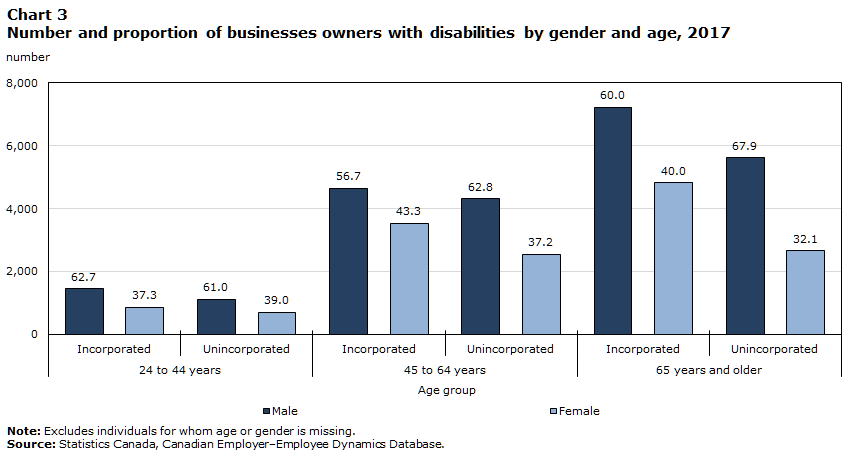

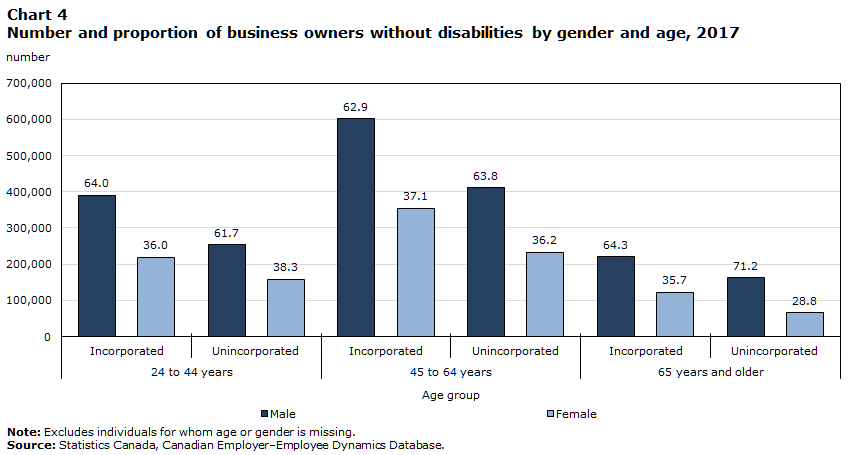

The age distribution among business owners with

disabilities (Chart 3) is noticeably different than that among business owners

without disabilities (Chart 4). The number of business owners with disabilities

increases with age for both unincorporated and incorporated businesses, with

the majority of business owners aged 65 and older (Chart 3). This is driven by

the fact that more than half of DTC claimants are aged 65 and older. In

contrast, business owners aged 45 to 64 without disabilities represent the

largest proportion of business owners (Chart 4).

There is a larger share of women with disabilities aged 45

and older who own incorporated businesses compared with unincorporated

businesses (Chart 3). In particular, 40.0% of owners of incorporated businesses

aged 65 and older who claimed the DTC are women, compared with 32.1% of owners

of unincorporated businesses. Among the 45-to-64 age category of business

owners with disabilities, 43.3% of incorporated businesses and 37.2% of

unincorporated businesses are owned by women. These two shares are higher than

what is observed for business owners without disabilities (37.1% and 36.2%)

(Chart 4). Nevertheless, while women account for a larger share of DTC

claimants among older age groups, business ownership remains male-dominated.

Data table for Chart 3

| Age group | Male | Female | Male | Female | |

|---|---|---|---|---|---|

| number | percent | ||||

| 24 to 44 years | Incorporated | 1,448 | 862 | 62.7 | 37.3 |

| Unincorporated | 1,114 | 712 | 61.0 | 39.0 | |

| 45 to 64 years | Incorporated | 4,643 | 3,539 | 56.7 | 43.3 |

| Unincorporated | 4,304 | 2,549 | 62.8 | 37.2 | |

| 65 years and older | Incorporated | 7,212 | 4,817 | 60.0 | 40.0 |

| Unincorporated | 5,609 | 2,652 | 67.9 | 32.1 | |

Data table for Chart 4

| Age group | Male | Female | Male | Female | |

|---|---|---|---|---|---|

| number | percent | ||||

| 24 to 44 years | Incorporated | 390,346 | 219,181 | 64.0 | 36.0 |

| Unincorporated | 254,250 | 158,081 | 61.7 | 38.3 | |

| 45 to 64 years | Incorporated | 601,891 | 355,163 | 62.9 | 37.1 |

| Unincorporated | 410,941 | 232,675 | 63.8 | 36.2 | |

| 65 years and older | Incorporated | 221,020 | 122,909 | 64.3 | 35.7 |

| Unincorporated | 162,356 | 65,778 | 71.2 | 28.8 | |

Immigrant business owners with disabilities are younger than non-immigrant

business owners with disabilities

Few immigrant business owners claim the DTC. For example,

among incorporated businesses, immigrant business owners represent 22.3% of

business owners who do not claim the DTC, compared with 7.6% of businesses

owners who claim the DTC (Table 3). Since similar shares of the Canadian

population of immigrants and non-immigrants have disabilities,Note the lower share of immigrants

claiming the DTC may be because of a higher proportion of immigrants,

particularly recent immigrants, who are not aware of the tax credit.

| Incorporated | Unincorporated | |||

|---|---|---|---|---|

| number | share of all incorporated (percent) | number | share of all unincorporated (percent) | |

| Business owners with disabilities | ||||

| Immigrant | ||||

| 25 to 44 years | 327 | 1.50 | 222 | 1.30 |

| 45 to 64 years | 956 | 4.20 | 771 | 4.60 |

| 65 years and older | 438 | 1.90 | 239 | 1.40 |

| 25 years and older | 1,721 | 7.60 | 1,232 | 7.30 |

| Non-immigrant | ||||

| 25 to 44 years | 1,983 | 8.80 | 1,604 | 9.50 |

| 45 to 64 years | 7,226 | 32.10 | 6,082 | 35.90 |

| 65 years and older | 11,591 | 51.50 | 8,022 | 47.40 |

| 25 years and older | 20,800 | 92.40 | 15,708 | 92.70 |

| Business owners without disabilities | ||||

| Immigrant | ||||

| 25 to 44 years | 187,605 | 9.80 | 112,807 | 8.80 |

| 45 to 64 years | 214,453 | 11.20 | 150,995 | 11.80 |

| 65 years and older | 24,895 | 1.30 | 15,309 | 1.20 |

| 25 years and older | 426,953 | 22.30 | 279,111 | 21.70 |

| Non-immigrant | ||||

| 25 to 44 years | 421,922 | 22.10 | 299,524 | 23.30 |

| 45 to 64 years | 742,601 | 38.90 | 492,621 | 38.40 |

| 65 years and older | 319,034 | 16.70 | 212,825 | 16.60 |

| 25 years and older | 1,483,557 | 77.70 | 1,004,970 | 78.30 |

Immigrant business owners who claim the DTC are younger

than non-immigrant owners who claim the DTC, in the case of both unincorporated

and incorporated businesses. For instance, 77.1% of immigrant business owners

with disabilities are aged 25 to 64, compared with 46.3% of non-immigrant

business owners with disabilities (Table 3). More than one-half of immigrant

business owners with disabilities are in the 45-to-64 age group.

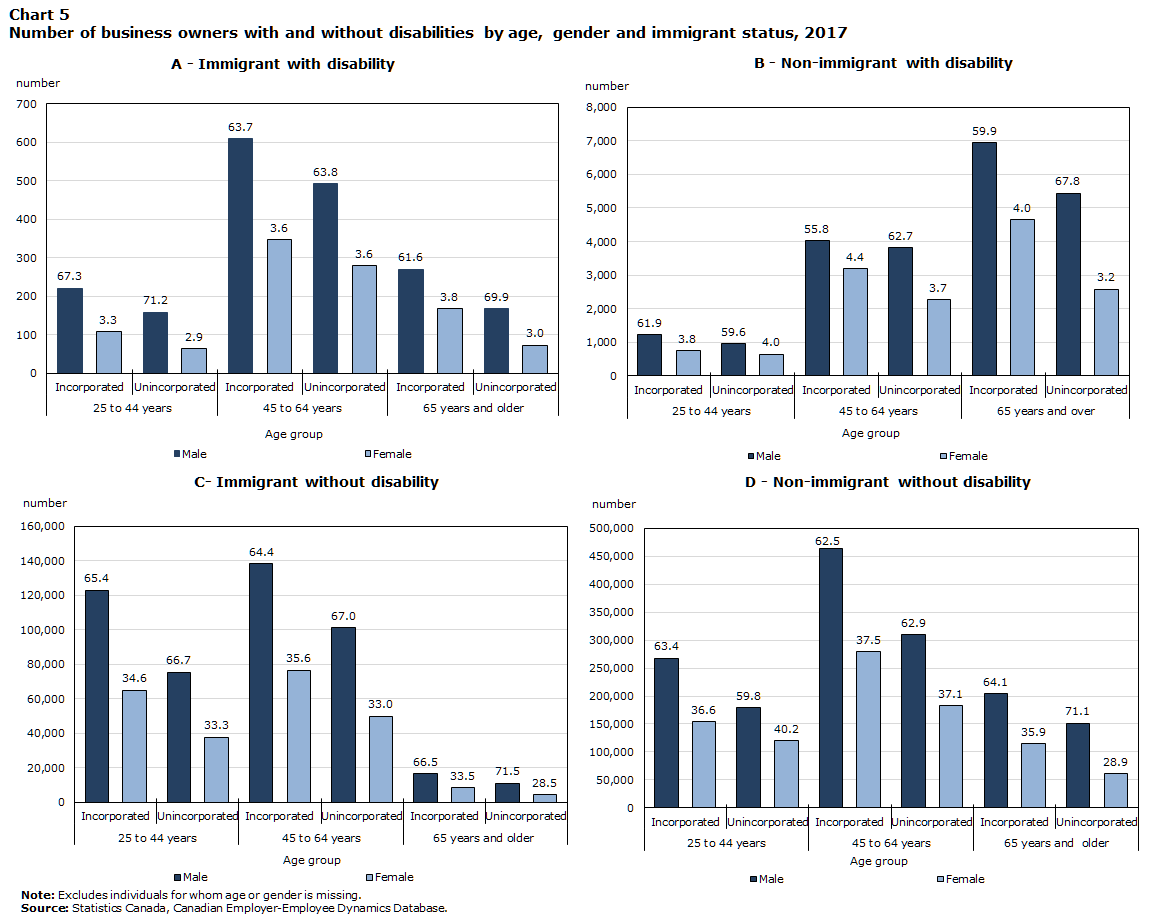

Among immigrant business owners, there is a higher share of

male business owners, regardless of disability. For instance, among the

youngest age category (25 to 44 years), 71.2% of owners of unincorporated

businesses are men (Chart 5A), compared with 59.6% of non-immigrant business

owners (Chart 5B). Moreover, the gender distribution among immigrant business

owners between the age groups (Chart 5A) is similar to that of business owners

without disabilities (Chart 5C).

In terms of the type of business, there are more women

business owners of incorporated businesses than of unincorporated businesses in

the oldest age category, whether the business owners are immigrants or

non-immigrants. For example, 38.4% of immigrant business owners aged 65 and older

of incorporated businesses are women, compared with 30.1% for unincorporated

businesses (Chart 5A). In addition, 40.1% of non-immigrant business owners in

the same age group of incorporated businesses are women, compared with 32.2% for

unincorporated businesses. For how gender and immigrant status intersect when

measured as an ownership share at the firm level, please see the appendix.

The median income of business owners without disabilities is consistently

higher than the median income of those with disabilities

The total personal income of each business owner can also

be found in the T1PMF. The median total personal income of business owners

without disabilities is consistently higher than that of business owners with disabilities

(Table 4), regardless of gender. Moreover, this median income ratio is

generally lower in the 45-to-64 age group. For instance, the median income of

women owners with disabilities is approximately 71.0% to 74.2% of that of women

business owners without disabilities. In contrast, while the median income

ratio is below 1 in the oldest age group (65 years and older), it is higher

than among younger age groups (younger than age 65) and ranges between 88.3%

and 96.1%.

Data table for Chart 5

| With disability | ||||||

|---|---|---|---|---|---|---|

| Age group | Male | Female | Male | Female | ||

| number | ||||||

| Immigrant | 25 to 44 years | Incorporated | 220 | 107 | 67.3 | 3.3 |

| Unincorporated | 158 | 64 | 71.2 | 2.9 | ||

| 45 to 64 years | Incorporated | 609 | 347 | 63.7 | 3.6 | |

| Unincorporated | 492 | 279 | 63.8 | 3.6 | ||

| 65 years and older | Incorporated | 270 | 168 | 61.6 | 3.8 | |

| Unincorporated | 167 | 72 | 69.9 | 3.0 | ||

| Non-immigrant | 25 to 44 years | Incorporated | 1,228 | 755 | 61.9 | 3.8 |

| Unincorporated | 956 | 648 | 59.6 | 4.0 | ||

| 45 to 64 years | Incorporated | 4,034 | 3,192 | 55.8 | 4.4 | |

| Unincorporated | 3,812 | 2,270 | 62.7 | 3.7 | ||

| 65 years and older | Incorporated | 6,942 | 4,649 | 59.9 | 4.0 | |

| Unincorporated | 5,442 | 2,580 | 67.8 | 3.2 | ||

| Without disability | ||||||

|---|---|---|---|---|---|---|

| Age group | Male | Female | Male | Female | ||

| number | ||||||

| Immigrant | 25 to 44 years | Incorporated | 122,730 | 64,875 | 65.4 | 34.6 |

| Unincorporated | 75,218 | 37,589 | 66.7 | 33.3 | ||

| 45 to 64 years | Incorporated | 138,098 | 76,355 | 64.4 | 35.6 | |

| Unincorporated | 101,112 | 49,883 | 67.0 | 33.0 | ||

| 65 years and older | Incorporated | 16,554 | 8,341 | 66.5 | 33.5 | |

| Unincorporated | 10,946 | 4,363 | 71.5 | 28.5 | ||

| Non-immigrant | 25 to 44 years | Incorporated | 267,616 | 154,306 | 63.4 | 36.6 |

| Unincorporated | 179,032 | 120,492 | 59.8 | 40.2 | ||

| 45 to 64 years | Incorporated | 463,793 | 278,808 | 62.5 | 37.5 | |

| Unincorporated | 309,829 | 182,792 | 62.9 | 37.1 | ||

| 65 years and older | Incorporated | 204,466 | 114,568 | 64.1 | 35.9 | |

| Unincorporated | 151,410 | 61,415 | 71.1 | 28.9 | ||

| DTC | non-DTC | DTC/non-DTC | |

|---|---|---|---|

| dollars | median | ||

| Incorporated | |||

| Age group and gender | |||

| 25 to 44 years, female | 44,181 | 54,500 | 0.81 |

| 25 to 44 years, male | 54,306 | 62,848 | 0.86 |

| 45 to 64 years, female | 43,908 | 61,832 | 0.71 |

| 45 to 64 years, male | 51,867 | 72,956 | 0.71 |

| 65 years and older, female | 58,501 | 63,436 | 0.92 |

| 65 years and older, male | 62,583 | 70,860 | 0.88 |

| Unincorporated | |||

| Age group and gender | |||

| 25 to 44 years, female | 25,415 | 36,664 | 0.69 |

| 25 to 44 years, male | 37,897 | 45,781 | 0.83 |

| 45 to 64 years, female | 30,553 | 41,181 | 0.74 |

| 45 to 64 years, male | 34,332 | 46,281 | 0.74 |

| 65 years and older, female | 42,352 | 44,487 | 0.95 |

| 65 years and older, male | 44,710 | 46,534 | 0.96 |

Characteristics of businesses owned by persons with disabilities

As described in the methods section, there are two ways to

identify businesses owned by persons with disabilities: the first is based on

whether a business has one or more owners who claim the DTC, and the second is based

on the shareholders and majority ownership among persons who claim the DTC. When

the former measure is applied, 1.6% of businesses are owned by persons claiming

the DTC. When the latter is used, it is 0.9%. The following sections will focus

on the first measure.Note

This section describes the firm-level characteristics of

the businesses that are owned by persons with disabilities compared with those of

businesses owned by persons without disabilities, aged 25 and older. An

enterprise is included if at least one of the shareholders claimed the DTC.

A slightly higher share of incorporated businesses owned by persons with

disabilities have fewer than one employee compared with businesses owned by

persons without disabilities

Of the total number of businesses, 1.5% of unincorporated

businesses are owned by persons with disabilities, compared with 1.7% of

incorporated businesses. The firm size distribution of businesses owned by

persons with and without disabilities is fairly similar, in that the majority

of incorporated and unincorporated enterprises have fewer than five employees

(Table 5). In unincorporated businesses, 96.8% of businesses owned by a DTC

claimant are in this size category, largely because of the high proportion

(89.0%) of self-employed individuals without paid help. There are more incorporated

businesses in the larger size categories, and these shares are very similar

across businesses owned by persons with and without disabilities. For instance,

9.0% of businesses owned by persons with disabilities have 5 to 20 employees,

compared with 10.4% of businesses owned by persons without disabilities. A

slightly higher share of businesses owned by persons with disabilities (64.6%)

have fewer than one employee compared with businesses owned by persons without

disabilities (58.5%), and this is consistent with evidence in the United

Kingdom that suggests that entrepreneurs with disabilities are more likely to

work alone than employ others (Jones and Latreille 2011).

| With disabilities | Without disabilities | |||

|---|---|---|---|---|

| number | share | number | share | |

| Incorporated | ||||

| Firm size | ||||

| 0 to fewer than 1 | 20,234 | 64.6 | 1,057,086 | 58.5 |

| 1 to fewer than 5 | 7,039 | 22.5 | 492,643 | 27.3 |

| 5 to fewer than 20 | 2,827 | 9.0 | 187,618 | 10.4 |

| 20 to fewer than 100 | 1,073 | 3.4 | 62,043 | 3.4 |

| 100 and over | 135 | 0.4 | 8,271 | 0.5 |

| Total | 31,308 | 100 | 1,807,661 | 100 |

| Unincorporated | ||||

| Firm size | ||||

| fewer than 1 | 15,466 | 89.0 | 1,013,336 | 89.7 |

| 1 to fewer than 5 | 1,363 | 7.8 | 87,610 | 7.8 |

| 5 to fewer than 20 | 471 | 2.7 | 25,323 | 2.2 |

| 20 to fewer than 100 | 61 | 0.4 | 2,697 | 0.2 |

| 100 and over | 24 | 0.1 | 176 | 0.00 |

| Total | 17,385 | 100 | 1,129,142 | 100 |

There are notable differences in the industry distribution of businesses

owned by persons with and without disabilities

The industry distribution of businesses varies across

business types (i.e., unincorporated and incorporated) and between businesses

owned by persons with and without disabilities (Table 6). Among unincorporated

businesses, nearly two-thirds of DTC claimant-owned businesses operate in real

estate and rental and leasing (27.8%); agriculture, forestry, fishing and

hunting (26.6%); and professional, scientific and technical services (10.4%). This

compares with one-half of businesses not owned by DTC claimants. The share of

non-DTC-claimant-owned businesses that operate in construction (10.4%) is

double the share of DTC claimant-owned businesses (5.2%).

DTC claimant-owned incorporated businesses are more likely

to operate in finance and insurance (14.6% compared with 9.4%) and in real

estate and rental and leasing (14.6% compared with 9.9%) than non-DTC-claimant-owned

businesses. In contrast, non-DTC-claimant-owned businesses (16.1%) are more

likely than DTC claimant-owned businesses (12.6%) to operate in professional,

scientific and technical services. Notably, the share of businesses operating

in goods-producing industries is almost identical between DTC claimant-owned

(22.4%) and non-DTC-claimant-owned (22.3%) businesses.

| Unincorporated | Incorporated | |||

|---|---|---|---|---|

| DTC | Non-DTC | DTC | Non-DTC | |

| Industry | share | |||

| Agriculture, forestry, fishing and hunting | 26.6 | 14.5 | 5.8 | 4.2 |

| Mining, quarrying, and oil and gas extraction | 0.2 | 0.2 | 1.2 | 0.9 |

| Utilities | 0.9 | 0.5 | 0.0 | 0.1 |

| Construction | 5.2 | 10.4 | 11.6 | 13.5 |

| Manufacturing | 1.7 | 1.9 | 3.9 | 3.6 |

| Wholesale trade | 1.0 | 1.1 | 4.2 | 4.0 |

| Retail trade | 5.0 | 5.1 | 7.0 | 7.4 |

| Transportation and warehousing | 4.1 | 7.2 | 3.9 | 6.0 |

| Information and cultural industries | 1.1 | 1.5 | 1.0 | 1.5 |

| Finance and insurance | 1.0 | 1.1 | 14.6 | 9.4 |

| Real estate and rental and leasing | 27.8 | 22.0 | 14.6 | 9.9 |

| Professional, scientific and technical services | 10.4 | 13.6 | 12.6 | 16.1 |

| Management of companies and enterprises | 0.1 | 0.1 | 1.9 | 1.7 |

| Administrative and support, waste management and remediation services | 4.1 | 5.3 | 3.7 | 4.1 |

| Educational services | 0.7 | 1.1 | 0.8 | 0.9 |

| Health care and social assistance | 2.5 | 3.8 | 5.3 | 6.8 |

| Arts, entertainment and recreation | 1.8 | 2.7 | 0.9 | 1.1 |

| Accommodation and food services | 1.4 | 1.5 | 3.5 | 4.4 |

| Other services (except public administration) | 4.3 | 6.6 | 3.7 | 4.4 |

In general, financial measures such as revenue and net income tend to be

higher for businesses owned by persons without disabilities

It is also possible to examine differences in financial

characteristics of DTC claimant- and non-DTC-claimant-owned incorporated

businesses, including revenue, assets, R&D expenditures and exports. In

general, financial measures tend to be higher for non-DTC-claimant-owned

businesses than for DTC claimant-owned businesses. Average net income, total

assets and R&D spending are all higher for non-DTC-claimant-owned

businesses, and the difference is statistically significant (Table 7). Average

revenue is also higher for non-DTC-claimant-owned businesses than DTC claimant-owned

businesses, but the difference is not statistically significant. Average

capital cost allowance, which is a proxy for investment, is very similar

between both types of businesses.

In terms of exports, DTC claimant-owned businesses are as

likely as non-DTC-claimant-owned businesses to be exporters. The average value

of exports is slightly higher for non-DTC-claimant-owned businesses.

| Incorporated | p-value | ||

|---|---|---|---|

| DTC claimant | Non-DTC claimant | ||

| dollars | |||

| Measure | |||

| Average revenue | 869,378 | 1,076,641 | 0.000Table 7 Note ‡ |

| Average net income | 108,971 | 161,160 | 0.000Table 7 Note ‡ |

| Average total assets | 2,103,988 | 2,298,397 | 0.777 |

| Average capital cost allowance (investment) | 26,647 | 26,945 | 0.917 |

| Average research and development spending | 1,239 | 1,926 | 0.000Table 7 Note ‡ |

| Exports | |||

| Average exports | 57,015 | 59,153 | 0.9122 |

| Number of exporters (number) | 546 | 28,730 | Note …: not applicable |

| Share that are exporters (percent) | 1.7 | 1.5 | Note …: not applicable |

Conclusion

The literature describes how persons with disabilities face

barriers when it comes to the labour market and business ownership. In Canada,

the lack of frequent and comprehensive data on business ownership among persons

with disabilities presents challenges in providing a full picture of this

group, which in turn is needed to design policies to address barriers to

business ownership. Using the CEEDD, this study attempts to fill this gap by

examining the sociodemographic characteristics of business owners with

disabilities, as well as the firm-level attributes of the businesses they own.

In terms of business ownership among persons with

disabilities, this study finds that 1.3% of individuals who claim the DTC are

shareholders of unincorporated businesses and 1.2% are shareholders of

incorporated businesses. These business owners tend to be older than business

owners who do not claim the DTC, and a slightly higher share tend to be women

compared with those who do not claim the DTC, although business ownership

remains male-dominated. A small proportion of business owners with disabilities

are immigrants.

While the data appear robust compared with other data

sources, this paper finds that about half of business owners with disabilities

are aged 65 and older. As this study uses the DTC, which is more likely to be

claimed by persons aged 65 and older, to identify persons with disabilities, it

may be underrepresenting younger business owners with disabilities. Future work

will use the Census of Population, and specifically the CSD, to capture a

broader sample of the population with disabilities. Nevertheless, this study is

a first step in using administrative data to provide a picture of business

owners with disabilities.

Finally, this study provided a snapshot of the

sociodemographics of business owners with disabilities and the firm-level

characteristics of the businesses they own. It finds similarities in terms of

firm size and financial characteristics compared with businesses owned by

persons without disabilities, but differences in industry distribution. Future

work could explore changes over time, including business growth and dynamics,

and stability of business ownership among business owners with disabilities, and

explore outcomes of businesses broken down further by gender and immigrant

status.

Appendix

Ownership share by different subgroups

The firm-level ownership share was generated for gender and

immigrant status variables where one shareholder has a disability and is aged

25 or older. As is evident from the previous demographic summaries, men have

the majority ownership in unincorporated and incorporated businesses with no

distinction between firms owned by individuals with and without disabilities.

What is notable is that there is a greater share of enterprises with equal

ownership for businesses owned by individuals with disabilities (Appendix Table A.1).

| DTC claimant | Non-DTC claimant | |||

|---|---|---|---|---|

| number | percent | number | percent | |

| Unincorporated | ||||

| Ownership type | ||||

| Equal ownership | 3,274 | 18.80 | 108,762 | 0.10 |

| Majority-owned by male | 9,238 | 53.10 | 694,994 | 0.62 |

| Majority-owned by female | 4,243 | 24.40 | 321,402 | 0.29 |

| Unclassified | 630 | 3.60 | 3,984 | 0.00 |

| Total | 17,385 | 100.00 | 1,129,142 | 1.00 |

| Incorporated | ||||

| Ownership type | ||||

| Equal ownership | 5,874 | 18.80 | 262,105 | 14.50 |

| Majority-owned by male | 15,484 | 49.50 | 1,065,664 | 59.00 |

| Majority-owned by female | 5,516 | 17.60 | 295,392 | 16.30 |

| Unclassified | 4,434 | 14.20 | 184,500 | 10.20 |

| Total | 31,308 | 100.00 | 1,807,661 | 100.00 |

Businesses with a majority

of non-immigrant shareholders capture almost the entire number of enterprises

that have business owners with disabilities (Appendix Table A.2). Although a similar

observation can be made for businesses owned by individuals without disabilities,

the difference is not as pronounced. Across all dimensions, equal ownership has

the fewest businesses.

| DTC claimant | Non-DTC claimant | |||

|---|---|---|---|---|

| number | percent | number | percent | |

| Unincorporated | ||||

| Ownership type | ||||

| Equal ownership | 150 | 0.90 | 9,365 | 0.80 |

| Majority-owned by immigrants | 1,220 | 7.00 | 244,744 | 21.70 |

| Majority-owned by non-immigrants | 16,007 | 92.10 | 874,785 | 77.50 |

| Unclassified | 8 | 0.00 | 248 | 0.00 |

| Total | 17,385 | 100.00 | 1,129,142 | 100.00 |

| Incorporated | ||||

| Ownership type | ||||

| Equal ownership | 370 | 1.20 | 28,238 | 1.60 |

| Majority-owned by immigrants | 1,942 | 6.20 | 345,841 | 19.10 |

| Majority-owned by non-immigrants | 26,863 | 85.80 | 1,290,493 | 71.40 |

| Unclassified | 2,133 | 6.80 | 143,089 | 7.90 |

| Total | 31,308 | 100.00 | 1,807,661 | 100.00 |

Businesses majority-owned by women immigrants represent

1.6% of all unincorporated businesses owned by persons with disabilities and 1.1%

of all incorporated businesses owned by persons with disabilities (Appendix Table A.3).

| DTC claimant | Non-DTC claimant | |

|---|---|---|

| Unincorporated | ||

| Female | 277 | 63,322 |

| Male | 688 | 161,404 |

| Incorporated | ||

| Female | 351 | 68,042 |

| Male | 1,112 | 222,915 |

References

Arim, R. 2015. A Profile of Persons with Disabilities Among

Canadians Aged 15 Years or Older, 2012. Canadian Survey on Disability.

Statistics Canada Catalogue no. 89-654-X. Ottawa: Statistics Canada.

Boylan, A., and T. Burchardt. 2002. Barriers to

Self-Employment for Disabled People. Report prepared for the Small Business

Service. London: Small Business Service.

Chan, P.C.W., H. Liu, and R. Morissette. 2018. Canadian

Employer-Employee Dynamics Database (CEEDD) User Guide – Overview. Ottawa: Statistics

Canada.

Duclos, É., and R. Langlois. 2003. Disability Supports

in Canada, 2001. Participation and Activity Limitation Survey. Statistics

Canada Catalogue no. 89-580-X. Ottawa: Statistics Canada.

Dunstan, T. 2003. Lower Rates of Self-Reported

Disability in Quebec than the Rest of Canada: An Investigation Into Some of the

Factors. PALS Data Interpretation Workshop. Ottawa: Statistics Canada.

Grekou, D., W. Gu, and B. Yan. 2020. Decomposing the

Between-firm Employment Earnings Dispersion in the Canadian Business Sector:

The Role of Firm Characteristics. Analytical Studies Branch Research Paper

Series, no. 443. Statistics Canada Catalogue no. 11F0019M. Ottawa: Statistics

Canada.

Grekou, D., J. Li, and H. Liu. 2018. The Measurement of

Business Ownership by Gender in the Canadian Employer-Employee Dynamics

Database. Analytical Studies: Methods and References, no. 017. Statistics

Canada Catalogue no. 11-633-X. Ottawa: Statistics Canada.

Huang, L. 2020. SME Profile Ownership Demographics

Statistics. Innovation, Science and Economic Development Canada Catalogue

no. u188-113. Ottawa: Innovation, Science and Economic Development Canada.

Jones, M. 2011. “Disability, employment and earnings: an

examination of heterogeneity.” Applied Economics, 43(4), 1001-1017.

Jones, M., and P. Latreille. 2011. “Disability and self-employment:

Evidence for the UK.” Applied Economics 43 (27): 4161–4178.

Kitching, J. 2014. Entrepreneurship and Self-employment

by People with Disabilities. Background paper for the Organisation for

Economic Co-operation and Development (OECD) Project on Inclusive

Entrepreneurship. Paris: OECD Publishing.

Lechner, M., and R. Vazquez-Alvarez. 2003. The Effect of

Disability on Labour Market Outcomes in Germany: Evidence from Matching.

IZA Discussion Paper no. 967. Bonn: IZA Institute of Labor Economics.

Mackenzie, A. 2013. Divergent Disability Rates in

Canada: Analysis of the Social Determinants of Disability. Doctoral thesis.

Ottawa: Carleton University.

Morris, S., G. Fawcett, L. Brisebois, and J. Hughes. 2018. A

Demographic, Employment and Income Profile of Canadian with Disabilities Aged

15 Years and Over, 2017. Statistics Canada Catalogue no. 89-654-X. Ottawa:

Statistics Canada.

Renko, M., S.P. Harris, and K. Caldwell. 2015. “Entrepreneurial

entry by people with disabilities.” International Small Business Journal 34 (5): 555–578.

Statistics Canada. 2020. Canadian Survey on Disability,

2017. (accessed October 26, 2021).

Wall, K. 2017. Low Income Among Persons with a

Disability in Canada. Insights on Canadian Society. Statistics Canada

Catalogue no. 75-006-X. Ottawa: Statistics Canada.