The Best Business Checking Accounts for 2023

What The Ascent looks for in a great business checking account

While every company will have slightly different needs when it comes to their business bank account, here are a few things all the best small business checking accounts have in common.

1. FDIC insurance

FDIC insurance protects your business funds — up to $250,000 per person per account type — against bank failure. However unlikely, you don’t want to risk losing all your hard-earned cash just because your bank couldn’t keep its doors open. So you must make sure that whichever business checking account you choose is backed by the FDIC. Nearly all brick-and-mortar and online banks have this protection, so it shouldn’t limit your options.

2. User-friendly account management tools

Whether you choose a brick-and-mortar or an online bank for your small business checking account, it should include an online portal and a mobile app where you can, at a minimum, view your balance, transfer funds, pay bills, and remotely deposit checks. This is often the fastest and simplest way for businesses to manage their money and it enables you to do so from just about anywhere.

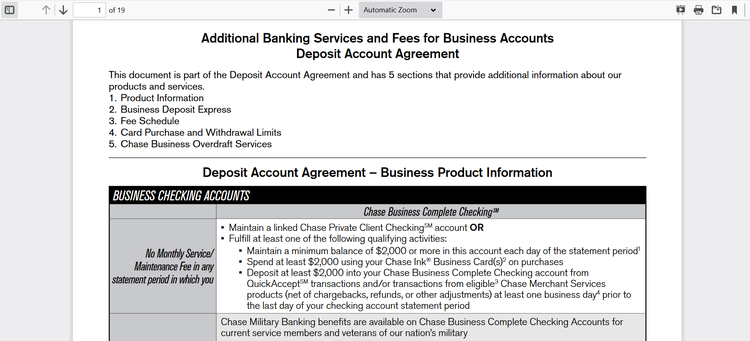

Always check the business checking account’s fee schedule before you sign up so you know exactly what your bank can charge you for. Image source: Author

3. Reasonable fees

How much you’ll pay for your business checking account depends in part on which bank you choose. Some online business checking accounts don’t charge maintenance fees or per-transaction fees at all, but these charges are common among brick-and-mortar business checking accounts.

What’s considered a reasonable fee depends in part on what you need from your business checking account. An account with a high monthly transaction and cash deposit limit, for example, will likely have a higher maintenance fee than a more basic business checking account. But the best business checking accounts will have fees that are in line with comparable accounts at other banks and won’t nickel-and-dime you for every little thing.

4. Good customer service

The best business checking accounts provide customers with multiple avenues for seeking support when they need it. Phone and email support are fairly common, and brick-and-mortar banks have branches where you can get in-person assistance from someone who knows you and your company. The best banks also have high customer satisfaction ratings, which you can gauge by looking at customer reviews and third-party customer satisfaction surveys.

What to consider before selecting the best business checking account for your business

Focus on the following factors when comparing business checking accounts to determine which is the best one for your business.

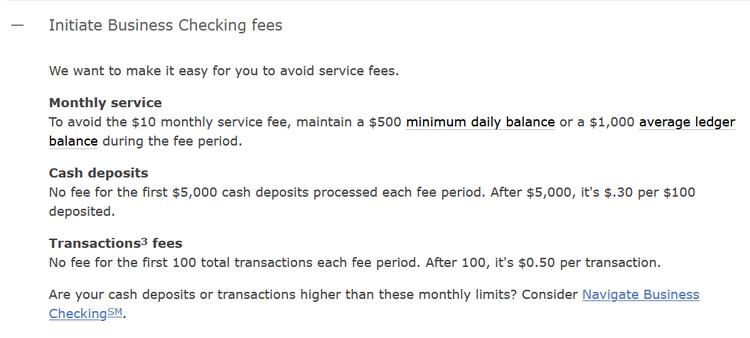

Most business checking accounts list their transaction and cash deposit limits clearly, though the per-transaction fees for exceeding these limits aren’t always as clear as in the example above. You may have to dig into the fee schedule to find this information. Image source: Author

1. Your monthly transaction volume

Many business checking accounts impose monthly limits on transactions and cash deposits. Exceeding these limits results in additional per-transaction fees, which can make the account much more expensive to own. Some business checking accounts do allow unlimited transactions, though sometimes these accounts are more expensive than accounts with lower limits.

Focus on choosing a business checking account that has a transaction limit that suits your business but still leaves you a little extra room in case you have a month where you need to deposit more cash or move your money around more than normal.

2. How you usually get paid

Brick-and-mortar banks tend to be a better choice for businesses that make a lot of cash deposits because they have large branch and ATM networks where customers can bring their cash. This usually isn’t an option with online banks. Some banks also charge for incoming and outgoing wire transfers, while others only charge for outgoing wire transfers.

Consider how you normally receive payments into your account and make sure you’re comfortable with any limits or fees associated with these types of deposits.

3. How much you plan to keep in the account

Business checking accounts often have a minimum opening deposit — usually a few hundred dollars or less. Some also have a minimum balance you must maintain if you hope to avoid monthly maintenance fees. If you’re not confident you can meet these requirements, you may want to explore some other options.

4. What other services you plan to use

If you’re interested in business loans, credit cards, or other deposit accounts, choose a business checking account at a bank that offers these services as well so you can manage all of your money in one place. If you use an accounting software to track your business finances, you may also want to look for a business checking account that integrates with this software to save you from having to manually transfer your banking information over.

What you will need in order to open a business checking account

In order to open a business checking account, you’ll need the following things.

1. Employer Identification Number or Social Security number

Sole proprietors may be able to open a business checking account with just their Social Security number, but if you want to open an LLC bank account, you will need an Employer Identification Number (EIN), which you can get for free on the IRS website.

2. Personal identification

You’ll need a driver’s license, passport, or other government-issued photo ID in order to open a business checking account.

3. Business license

Your bank will want to see your business license that proves that you are operating a legitimate business in your state. It should list your name, any business partners’ names, and your business name.

4. Business organization documents

You must present your articles of incorporation or articles of organization in order to open a business checking account. What these documents must entail varies slightly from state to state, but it should include your business name and address as well as an outline of how your company is structured, the type of business you do, and who its registered agents are.

5. Certificate of assumed name

If your business advertises to customers using something other than its legal name, you must have a certificate of assumed name, also known as a “doing business as” name. Your bank will need to see this when you open your business checking account.

6. Partnership agreement

If you have business partners, you will need to present your partnership agreement to your bank outlining each partner’s rights and responsibilities to the business.