Jumpstart tackles funding for startups

According to Chiura, Grow VC has US$30 million in funds that is available for entrepreneurs to tap into. Mind you the platform operates in over 100 countries so there is bound to be a fair amount of competition for that funding.

The Grow VC model is interesting in that unlike traditional funding models it leverages the power of thousands of investors who each place fairly small amounts into a startup in exchange for equity typically up to 15%. The model provides a win-win proposition for both parties as investors minimise their risk exposure and startups part with a minimal amount of equity and therefore retain control.

Crowdfunding Grow VC believe is ideal for Zimbabwe as the small risk exposure for each investor may prove to be attractive. He encouraged entrepreneurs to also explore local government facilities such as the Youth Empowerment Fund and myriad of VC firms that are active on the continent. He pointed The Acumen Fund because who are very active in Africa and have a special focus on projects with a strong social impact. The need for local techies to think outside the sandbox was demonstrated by the fact that there was no Zimbabwean representative and the recent Open Innovation Africa Summit (OIAS) held in May in Kenya. OIAS has strong partners in Nokia and the World Bank who are prepared to support great ideas.

An ideal example of what a crowd funded start-up in Zimbabwe would look like is CINTEP a manufacturer of water efficient shower heads. The company received an initial round of US$100,000.00 from 300 investors in return for 15% equity.

Although Grow VC has been in Zimbabwe for about a year they are yet to make an investment here. This Munya explained is not a bad sign as there is a lot of potential in the Zimbabwean space, the challenge is for entrepreneurs to present ideas that are at least backed up by an MVP (Minimal Viable Product). Present at the talk were a couple of developers who have already have products that meet this criteria, for example Tawanda Kembo’s IPaidabribe.

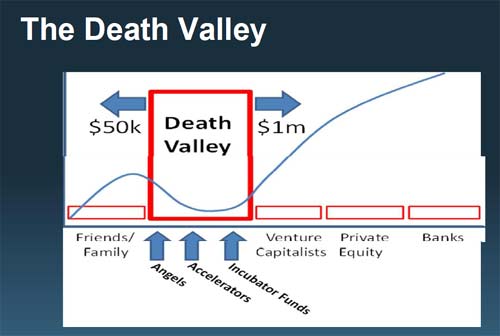

An interesting slide in Munya’s presentation was this one:

So the Valley of Death is that period in the life of a start-up where most ideas stall and expire. For one reason or another the idea simply fails to take off, maybe the technology is not good enough, the team is incompetent, they run out of money or the product fails to get market traction. In Zimbabwe as Munya argued, the valley of death extends from the $0-$50K funding stage as there is a scarcity of funds. By approaching Grow VC and other innovative VC firms that are sprouting around Africa entrepreneurs need not fear walking in the valley of death.

It’s important, Munya emphasised for founders to prepare for all manner of criteria in winning approval from investors and the whole due diligence and valuation exercise can take months to complete. However, for start-ups seeking fairly small amounts like US$5,000 the valuation exercise can be fairly quick.

A key concern for local developers the protection of Intellectual Property not just on the Grow VC platform but also in the whole venture funding process. Jumpstarters had varied views on this point and it certainly provided for animated discussion.

For entrepreneurs interested in contacting Munya these are his contact details: email: munya(at)growvc.com ; Tel: +263 777 627 049

For pictures of the event check our facebook page

Photo Credit: Charles Saki