Best Business Card Offers: Jan 2024

Our rating: 4.50/5.00 stars. Cardholder Review Ratings: 1,345 reviews give it 4.25/5.00 stars as of 9/1/23.

The entire lineup of Chase Ink business credit cards are known for having some of the biggest sign-up bonuses. That includes no annual fee cards like this one, which offers $900 in bonus cash back that you earn after spending $6,000 in the first 3 months.

That’s not the only area where this card offers big bonus opportunities. It also earns 5% cash back at office supply stores and on internet, cable, and phone services, up to a $25,000 spending cap each account anniversary year. That makes it an excellent business credit card for small businesses with a traditional office environment and the expenses that come with it, such as office supplies and an internet/phone package.

Since this card has a $25,000 yearly spending cap in its bonus categories, it probably won’t be a fit for businesses with high spending. It’s more well-suited for new businesses, startups, and businesses that operate on tight budgets, considering its rewards structure and a 0% intro APR.

Leveraging your business card rewards:

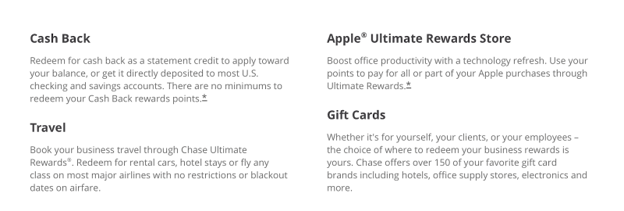

- Welcome offer: Huge sign-up bonus you can redeem for cash back, travel, and more.

- 0% intro APR for 12 months on purchases: Pay off large expenses over time with no interest charges. The go-to variable APR applies after this intro period ends.

- High cash back rates: Earn up to 5% back in popular business spending categories, with multiple cash back redemption options.

- Complimentary protections:

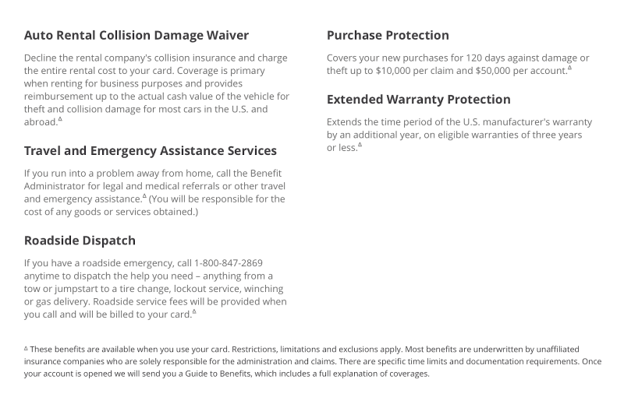

- Auto rental collision damage waiver

- Purchase protection

- Extended warranty protection

- Free employee cards: You can also set up individual spending limits.

View more pros & cons of the Ink Business Cash® Credit Card

Our rating: 4.50/5.00 stars. Cardholder Review Ratings for Ink Business Unlimited® not provided on the Chase site.

This Chase Ink card is one of the most valuable and easy-to-use business credit cards. It has a straightforward rewards setup — an unlimited 1.5% cash back on purchases. That’s the best unlimited flat rate we’ve seen from a no annual fee business card.

It also has one of the largest sign-up bonuses we’ve seen from a no annual business card, and from most business cards, period. New cardholders earn a bonus after spending $6,000 on purchases in the first 3 months. As long as your business spends at least $2,000 per month, you’ll be able to earn quite a bit back. And if you need extra time to pay off any purchases, this card has 12 months of 0% intro APR on purchases.

With its benefits, this is a great business card for busy business owners who don’t want to spend more time than necessary managing their credit cards. You can use this card for all your business spending and set up cards for your employees, as well.

Leveraging your business card rewards:

- Welcome offer: Huge sign-up bonus with redemption options that include cash back, travel, and gift cards.

- 0% intro APR for 12 months on purchases: Use this intro rate for major expenses that you need some time to pay off. After that intro period is over, the go-to variable APR applies.

- Unlimited 1.5% cash back: A competitive rate across all purchase categories.

- Free employee cards: You can also put individual spending limits on each one.

- Complimentary protections:

- Auto rental collision damage waiver

- Purchase protection

- Extended warranty protection

View more pros & cons of the Ink Business Unlimited® Credit Card

Our rating: 4.50/5.00 stars. Cardholder Review Ratings: 58 reviews give it 4.50/5.00 stars as of 9/1/23.

This Chase Ink card is one of the top business credit cards for business owners who travel often. It’s Chase’s business travel card, and Chase is known for having an excellent travel rewards program.

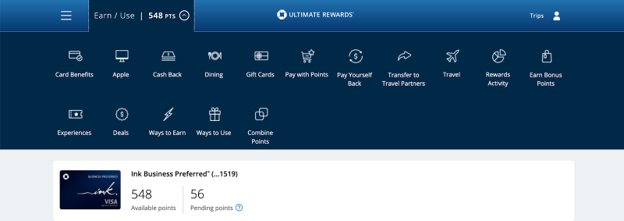

While all the Chase Ink cards have large sign-up bonuses, this one has the most potential value. New cardholders earn 100,000 for spending $8,000 in the first 3 months. Points can be redeemed toward travel at a rate of $0.0125 per point.

This card is unique in that it earns bonus points on advertising purchases, including with social media sites and search engines, up to a yearly spending cap. That makes it well-suited for online businesses, including online shops and anyone who advertises their services through search engine or social media ads.

If you have accounts with airline and hotel loyalty programs, you’ll also appreciate the option of transferring points to Chase travel partners. That includes quite a few popular airlines and hotels. While travel credit cards do have a bit more of a learning curve, if you don’t mind that, you can save a ton of money on your trips with this card’s travel points.

Leveraging your business card rewards:

- Welcome offer: Huge travel rewards sign-up bonus you can redeem at a fixed rate for travel purchases or transfer to travel partners.

- Big bonus rewards: Earn 3 points per $1 on the first $150,000 in combined purchases in the following categories each account year:

- Shipping purchases

- Advertising purchases made with social media engines and search engines

- Internet, cable, and phone services

- Travel

- Free employee cards: With individual spending limits you set.

- Complimentary protections:

- Trip cancellation/trip interruption insurance

- Auto rental damage collision waiver

- Cell phone protection

- Purchase protection

- Extended warranty protection

- Flexible redemption options: Including travel bookings, transfers to travel partners, cash back, and more.

View more pros & cons of the Ink Business Preferred® Credit Card

American Express Business Gold Card Expert Review

Our rating: 4.25/5.00 stars. Cardholder Review Ratings for American Express Business Gold Card not provided on the American Express site.

Most business cards have fixed bonus categories, so you only benefit if your spending matches those categories. This American Express card is a business card built around your spending, with bonus categories based on where you spend the most. It earns 4 points per $1 on the top two categories from a list of six where your business spends the most each billing cycle, up to a spending cap of $150,000 per calendar year. Terms apply.

There’s a diverse selection of bonus categories, including airfare purchased directly from airlines, U.S. purchases for advertising in select media, and U.S. purchases for shipping, among others. That makes it fairly easy to accumulate bonus points with this card. Terms apply.

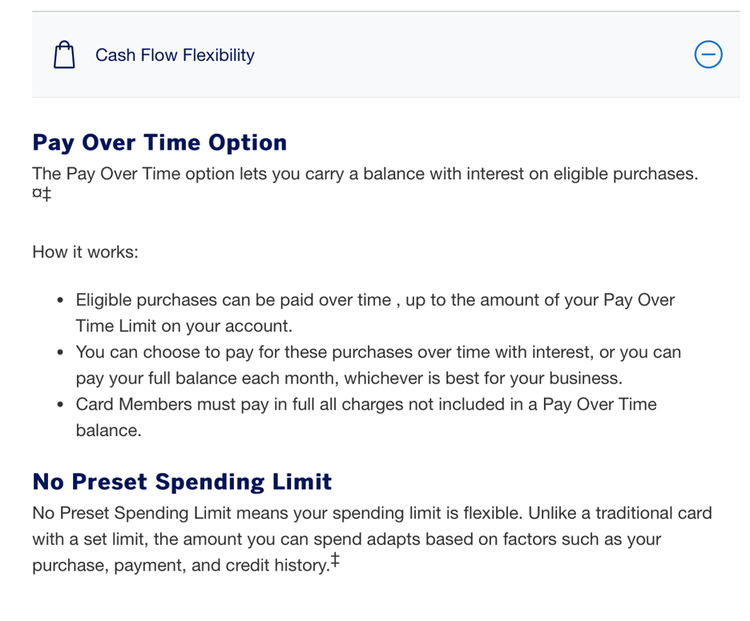

American Express is also known for being a great card issuer to deal with. It regularly ranks at the top of J.D. Power rankings for customer satisfaction and its cards (including this one) have excellent complimentary protections. This card, in particular, is great for business owners with high spending, as it has no preset spending limit and a Pay Over Time option. Terms apply; see rates and fees. With its high-value rewards and other useful benefits, this was our experts’ pick for the best business credit card of 2023.

Leveraging your business card rewards:

- Welcome offer: Large travel rewards welcome offer with high spend requirement.

- Flexible bonus rewards: Earn bonus points in the eligible categories where you spend the most.

- Track your expenses: Get access to useful expense management tools, including yearly spending summaries and integrate your expenses to Intuit QuickBooks®.

- Add employees to your account: You can get employee cards and set up a trusted team member as an account manager to oversee your account.

- Complimentary protections:

- Baggage insurance plan

- Car rental loss and damage insurance

- Extended warranty

- Purchase protection

- Manage your cash flow: Make the purchases you need with no preset spending limit and use the Pay Over Time option if you need to carry a balance.

- Terms apply.

View more pros & cons of the American Express Business Gold Card

Blue Business Cash™ Card from American Express Expert Review

Our rating: 3.75/5.00 stars. Cardholder Review Ratings for Blue Business Cash™ Card from American Express not provided on the American Express site.

As a business owner, and especially if you have a new business, you may want to keep it simple. Earn a high cash back rate on all types of purchases, avoid unnecessary fees, and have a card issuer that you can trust. That’s where this American Express card shines.

It earns a flat rate of 2% cash back on everyday eligible business purchases, up to a spending cap of up to $50,000 per calendar year. (See rates and fees.) It earns 1% on other eligible purchases. Terms apply. The cash back structure is easy to understand, and 2% on all types of eligible purchases is as high as we’ve seen from a no annual fee business card. Overall, this is a top business card for earning straightforward cash back.

There are also a few tools to help you better manage your business expenses. You can pay them off over time with 12 months of 0% intro APR. After that intro period, the go-to variable APR applies. If you need to spend more than your credit limit, you can potentially do so with expanded buying power. Terms apply.

Because of the $50,000 spending cap on this card’s 2% cash back rate, it’s a natural fit for businesses with lower spending, such as new businesses looking to make every dollar count. Terms apply. Businesses that spend $5,000 or more per month will likely want to go with a different card.

Leveraging your business card rewards:

- Cash back rewards: High cash back rate on up to $50,000 per calendar year.

- Low intro APR: Finance new purchases at a 0% intro APR for 12 months.

- Manage business expenses: Connect to QuickBooks® to save time and review a year-end summary for an interactive overview of your business spending.

- Add employees to your account: Give them purchasing power by requesting employee cards for them, and set up a trusted employee as your account manager.

- Complimentary protections:

- Car rental loss and damage insurance

- Extended warranty

- Purchase protection

- Terms apply.

View more pros & cons of the Blue Business Cash™ Card from American Express

Our rating: 4.00/5.00 stars. Cardholder Review Ratings: 2018 reviews give it 4.60/5.00 stars as of 9/1/23.

With competitive prices on practically everything it offers, Costco is a popular place to shop for small business owners. It also offers Costco Business Centers, where you can stock up on office supplies and bulk food and drinks, as well as get specialized services, such as printing. This business card is made for business owners who shop at Costco often.

It earns bonus cash back at Costco, and that’s not even the best perk it offers. What really makes this card special is an incredible 4% cash back on eligible gas and EV charging, up to a spending cap of $7,000 per year. It also earns 3% at restaurants and eligible travel, including Costco Travel, 2% on other Costco purchases, and 1% on other purchases.

A 4% cash back rate on gas and EV charging is the highest we’ve found, and it means this card is a top choice for driving-based businesses. If you or your employees go to clients’ homes, or if you’re a freelancer driving for rideshare services, you’ll be able to earn quite a bit of cash back with this card. Just keep in mind that a Costco membership is required to get it, and you earn that cash back as a reward certificate.

Leveraging your business card rewards

- Big cash back rewards: Earn bonus cash back on gas and EV charging (up to $7,000 yearly spending cap), restaurants, travel, and at Costco.

- Use your Costco credit card as your membership ID: You don’t need to carry a separate Costco membership card.

- Valuable complimentary protections and other perks

View more pros & cons of the Costco Anywhere Visa® Card by Citi

Capital One Spark 2X Miles Expert Review

Our rating: 5.00/5.00 stars. Cardholder Review Ratings: 717 reviews give it 4.50/5.00 stars as of 9/1/23.

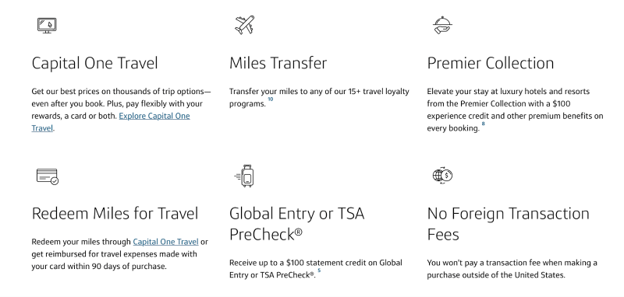

Capital One’s travel cards usually provide a nice blend of value and ease of use, and that’s true with this travel card for businesses. It has an excellent sign-up bonus and rewards structure, earning an unlimited 2 miles per $1 on purchases. With its benefits, it’s a smart choice for travel-heavy businesses that want rewards they can redeem quickly and conveniently.

In addition to this card’s generous rewards, its spending tools can help you better manage your business expenses. You can assign an account manager to handle your credit card account for you. To simplify your taxes, you can get an itemized, year-end report of transactions, and purchase records are downloadable in multiple file formats depending on what your business uses.

Businesses are a popular target for fraud, and this card has useful tools to help protect from that. It offers virtual card numbers to pay online without exposing your actual card number to merchants, so this card is great for businesses that frequently order items online.

Leveraging your business card rewards:

- Large welcome offer: Earn travel miles for a reasonable spend requirement.

- Unlimited 2x miles per $1: Plus, earn 5 miles per $1 on hotels and car rentals booked through Capital One Travel.

- Multiple ways to use miles: Redeem at a fixed rate of $0.01 per mile toward travel or transfer to Capital One travel partners.

- Extra travel perks: Get a Global Entry/TSA PreCheck credit (once every four years).

- Set up employee access: Free employee cards with customizable spending limits and assign an account manager to make purchases and payments, review transactions, and resolve any problems.

- Complimentary service and protections: Including extended warranty protection on eligible purchases and more.

View more pros & cons of the Capital One Spark 2X Miles

Capital One Spark 1% Classic Card Expert Review

Our rating: 3.75/5.00 stars. Cardholder Review Ratings: 1,907 reviews give it 4.30/5.00 stars as of 9/1/23.

Most of the top business credit cards require a high credit score, and if you’re not there yet, it may take some time to build your credit. If you need a business credit card now, then your best option is one with more lenient approval requirements. This is a credit card available to business owners with fair/average credit, so it’s much easier to get than most others.

One of the things we love about Capital One is it explains the credit guidelines for its cards on its website. For this card, you can qualify if you have limited credit history, meaning you’ve been using credit for less than three years, or even if you’ve defaulted on a loan in the last five years.

This is a basic, starter business card, but it has all the most important perks. There’s no annual fee, which we consider a must for a card you use to build credit and manage business spending. It earns an unlimited 1% cash back on purchases. And it has all the same account management tools Capital One offers on its very best business credit cards, including free employee cards with customizable credit limits, the option to assign an account manager, and detailed spending reports.

Leveraging your business card rewards:

- Unlimited 1% cash back: Earn even more on business travel expenses — an impressive 5% cash back on hotels and rental cars booked through Capital One Travel.

- Employee access: Add free employee cards with customizable spending limits to your account and set up an account manager who can make purchases and payments, review transactions, and resolve issues for you.

- Complimentary service and protections: These include extended warranty protection on eligible purchases and roadside assistance.

- No foreign transaction fee: Many cards for building credit charge extra on foreign transactions, so it’s nice that this one doesn’t.

- Easy application process: You can apply within about 10 minutes with your information and your business’s information. A business tax ID number (TIN) and employer identification number (EIN) aren’t required if you don’t have them — you can apply as a sole proprietorship using your Social Security number (SSN).

View more pros & cons of the Capital One Spark 1% Classic Card

Capital One Spark 2% Cash Plus Expert Review

Our rating: 5.00/5.00 stars. Cardholder Review Ratings: 1,196 reviews give it 4.10/5.00 stars as of 9/1/23.

Running a business is usually time-consuming, and it can be expensive, too. This card is ideal for business owners with big spending and not a lot of free time. It’s a cash back card with a simple rewards structure and valuable perks, and the more you spend, the better it gets.

It earns an unlimited 2% cash back, which is the highest unlimited rate we’ve seen across all purchases. Normally, this card has a $150 annual fee, but you get that fee refunded every year that you spend at least $150,000. We haven’t seen any no annual fee business cards that earn an unlimited 2%, so if you reach that spend requirement, this card offers unprecedented value.

Capital One also provides plenty of useful account management tools. You can set up payments to all your vendors online. You can even have payments sent to vendors that don’t accept cards for a 2.9% fee. While this is a pay-in-full charge card, if you want to keep cash longer, you can defer payments until the next billing cycle and extend float up to 45 days. You also get year-end spending summaries, free employee cards, and can connect your card to several popular ERP platforms, including QuickBooks® and Expensify®.

Businesses on a tight budget will probably want to pick another card. This card’s benefits make it more of a fit for established businesses with at least $10,000 to $15,000 in monthly expenses. If so, your business will be able to earn this card’s massive sign-up bonus and potentially get the annual fee refunded each year

Leveraging your business card rewards:

- Welcome offer: Huge one-time cash bonus with a sizable spend requirement.

- Unlimited 2% cash back: Plus, earn an unlimited 5% cash back on hotels and rental cars booked through Capital One Travel.

- No pre-set spend limit: Get a credit limit that adapts to your needs.

- Set up employee access: Add free employee cards and customize their spending limits. Add an account manager who can handle everyday account tasks for you, including payments, reviewing transactions, and resolving any problems.

- Complimentary service and protections: These include extended warranty on eligible purchases made with your card and roadside assistance.

- Detailed transaction reports: Download purchase records in multiple file formats, view itemized year-end summaries, and get a list of recurring transactions being charged to your card.

View more pros & cons of the Capital One Spark 2% Cash Plus

Capital One Venture X Business Credit Card Expert Review

Our rating: 4.75/5.00 stars. Cardholder Review Ratings for Capital One Venture X Business Credit Card not provided on the Capital One site.

Some business cards can work well for just about any business owner, no matter how much they spend. No annual fee cash back cards are a good example. This Capital One card goes the other direction. It’s definitely not for businesses with tight budgets, but it’s one of the very best business travel cards for big spenders. Specifically, it’s for business owners who put at least $10,000 per month on their credit card.

New cardholders can earn a massive sign-up bonus, but it does have a very high spend requirement. That’s one reason why we only recommend this card for businesses with substantial monthly spending. It also has a straightforward, high-value rewards structure: An unlimited 2 miles per $1 on purchases, with higher bonus rates for bookings made through Capital One Travel.

This is a pay-in-full charge card with no preset spending limit. It’s not designed for carrying a balance, and there’s an extra fee if you do. One feature we really like is that the spending limit adapts based on your spending behaviors, payment history, credit profile, and other factors. It’s not like most business credit cards, where you need to request a credit limit increase to get more spending power.

While this is a premium travel card, it’s easy to use and to get your money’s worth. Features include travel spending credits and flexible miles you can redeem by transferring to Capital One partners or at a fixed rate for travel purchases. It also has excellent business management tools, including free employee cards, virtual card numbers for staying safe online, and detailed spending and transaction reports.

Leveraging your business card rewards:

- Huge welcome offer: One of the largest travel rewards sign-up bonuses we’ve seen.

- Unlimited 2X miles per $1: Plus, book through Capital One Travel to earn 5X miles per $1 on flights and 10X miles per $1 on hotels and rental cars.

- Business management tools: Including free employee cards with customizable spending limits, purchase records, year-end summaries, and a list of recurring transactions charged to your card.

- Complimentary services and protections: Including extended warranty protection, purchase protection, and return protection on eligible purchases.

- Top-tier travel benefits: Including flexible travel reward redemptions, spending credits, and luxury hotel perks.

View more pros & cons of the Capital One Venture X Business Credit Card