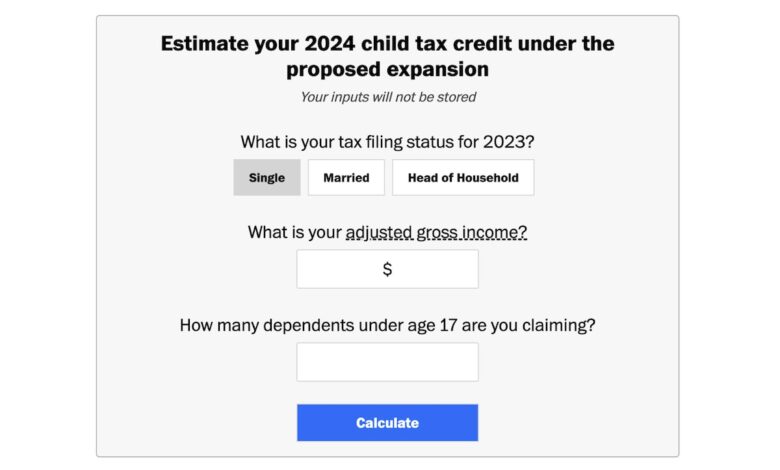

Calculate how much you would get from the expanded child tax credit

An expanded child tax credit passed the House of Representatives on Wednesday night. If the bill is enacted, it would significantly increase the child tax credit for lower-income families with multiple children.

Here’s how your child tax credit would change:

Estimate your child tax credit under the proposed expansion

Your inputs will not be stored

What is your tax filing status for 2023?

What is your adjusted gross income?

How many dependents under age 17 are you claiming?

How is the expanded child tax credit different in 2023?

The expansion would primarily benefit lower-income families for tax year 2023, especially those with multiple children.

The amount a family receives depends on its income. For low-income families, the credit “phases in”: A larger income means a larger credit, up to $2,000 per child.

Under the current version, the child tax credit phases in for lower-income families at the same rate no matter how many children are in the family. A married couple making $12,500 a year is eligible for a credit of $1,500, whether they have one child or three.

Under the expansion, the maximum amount a lower-income family can receive is multiplied by the number of children in the family. A married couple making $12,500 a year would be eligible for a credit of $1,500 if they had one child, $3,000 if they had two children, $4,500 if they had three children, and so on.

[The child tax credit may expand. Here’s what it means for you.]

If a family’s child tax credit is bigger than its income tax bill, the family can receive some of the remainder as a tax refund — but not necessarily all of it.

Currently, a family could receive at most $1,600 of the remainder as a refund. Under the expansion, a family can receive up to $1,800 of the remainder for the 2023 tax year. By 2025, families would be able to receive the full tax credit as a refund if they owe no income taxes, as long as they have an income of at least $2,500.

How much is the tax credit per child?

The maximum tax credit per child is $2,000 for tax year 2023. The maximum credit is set to increase with inflation in 2024 and 2025.

How many children can you claim?

There is no maximum number of children. To qualify, children must be claimed as your dependent and live with you for at least half of the year and meet other conditions explained by the IRS.

What do I need to do to claim the expanded child tax credit?

Lawmakers are hoping to pass the tax package so the new benefit can take effect in time for the upcoming tax filing season. If it does, you do not need to do anything to claim the expanded child tax credit for 2023 — just file your taxes as normal.

Tax forms for 2023 reflect the old version of the child tax credit rather than the proposed version. If you would be eligible for a larger refund under the expansion, the IRS will automatically adjust your return. The IRS estimates that adjusted refunds would go out six weeks after the expansion is enacted, according to House Republicans.

How would the child tax credit change in the future?

The expansion would benefit a broader range of families in 2024 and 2025 by allowing a higher maximum credit, greater refundability and more flexibility on the income a family can use to calculate the credit.

The total amount of the credit would be adjusted for inflation beginning in 2024. The Center for Budget and Policy Priorities predicts the credit would be $2,100 by 2025, but it may increase as soon as 2024 according to the Tax Foundation.

The credit is set to become fully refundable in 2025, meaning that families would benefit from the full child tax credit even if they do not owe federal income taxes.

Beginning in 2024, families would also have access to a “lookback” provision: Families can use whichever income over the past two years gives them a greater credit.

The most recent expansion and earlier increases to the child tax credit are set to expire in 2026, however. If Congress does not extend the expansion or the earlier increases, the maximum size of the credit will return to $1,000 per child.

About this story

All estimates and examples assume the taxpayer is taking the standard deduction.