Watch | Business Matters | How bad is the ‘winter of funding’ for start-ups now?

The winter of start-up funding, as they call it in the industry, has certainly set in. The zest with which funds had poured in over 2021 was missing as we progressed over the year 2022.

PwC India says in a recent report that though late-stage start-up deals as well as growth-stage deals were seeing an impact from the global slowdown, the overall Indian start-up ecosystem continued to grow with continuing investments at early stages.

“This segment saw funding growth of nearly 12% in 2022 as compared to 2021. As of December 2022, there were more than 1,800 funded start-ups in India – a base that has consistently grown during 2022”.

Let’s look at some interesting data points:

Arun Natarajan, founder, Venture Intelligence, a data research and analysis firm focussed in the private equity and venture capital space says a couple of trends are evident: One, funds flow into start-ups won’t dry up, and two, the focus will – and it already has started to – shift from B2B to B2C.

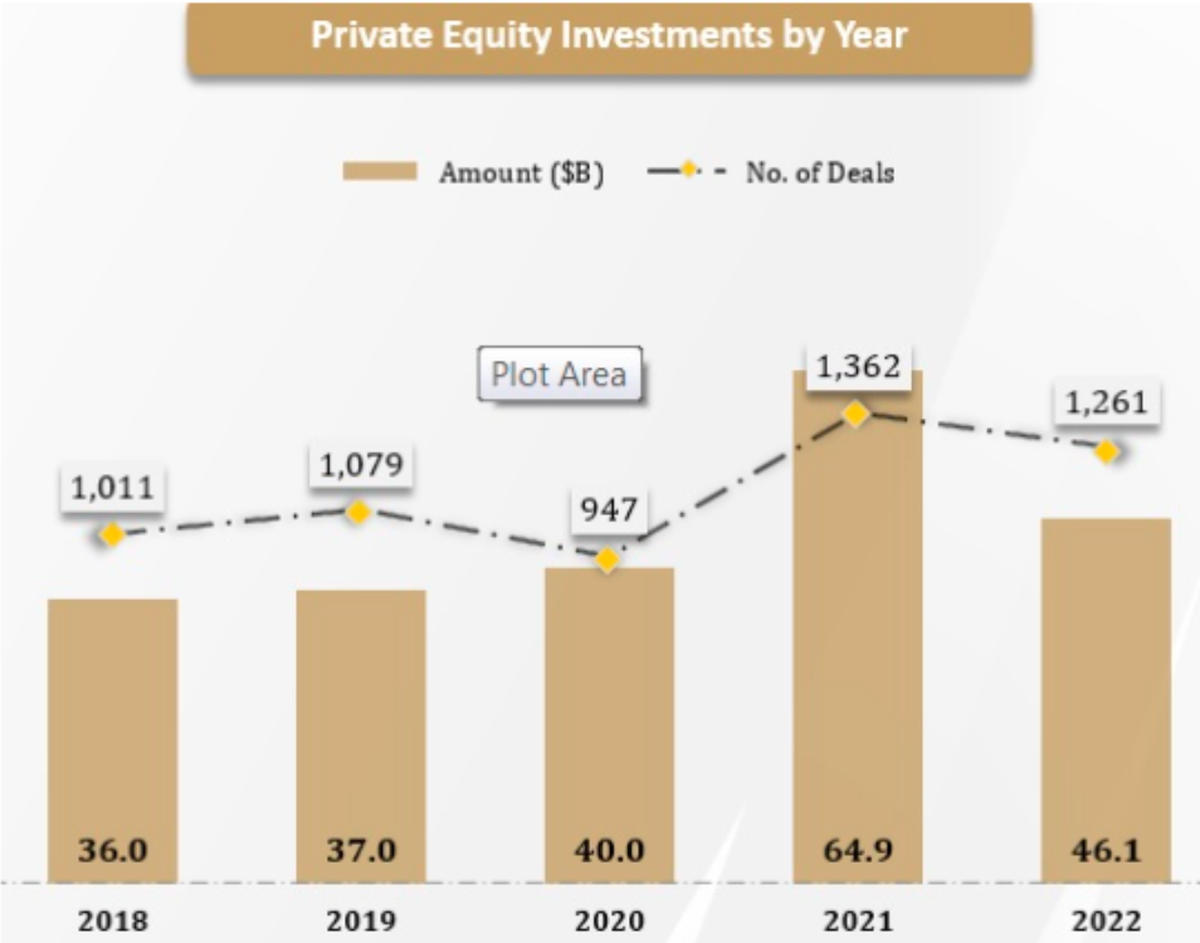

But before we gaze into the crystal ball for the future, here’s how the wonderful days of 2021 panned out.

At a time when cost of funds was low and the US Federal Reserve raising rates was not even on the horizon, the likes of pension funds had cash that was almost there for the asking. It was almost like the LPs / GPs (limited partners and general partners) had to merely pick up the cash and invest in companies.

Mr. Natarajan points out that even conservative entrepreneurs began accepting sequential rounds of funding one after another just months apart. In one instance, he points out, a highly conservative company raised $125 mn and in a few months raised another $250 mn. “There is no way that the company could have burned the first $100 mn within the time the next $250 mn came up.”

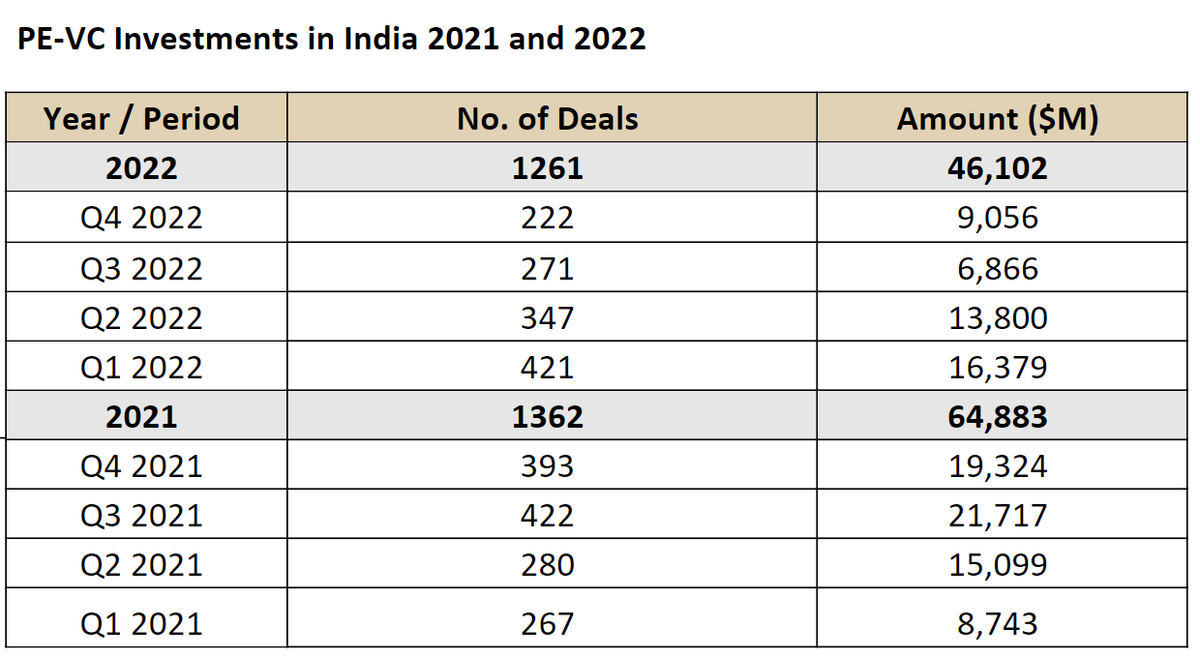

The chart here shows how over the 4 quarters of 2021, there has been a rise to a crescendo, continuing somewhat into Jan-March quarter of 2022. And then the slide is evident – both in the number of deals and value. The downshift is evident from last two quarters ended December, which together don’t add up to the investment value seen in just the final quarter of 2021.

But the overall funding momentum of 2021 had carried on to 2022. 2021 was a record year. 2022 was still the second highest ever. A five-year trend is evident in the chart above.

Unicorns have hogged the limelight for a while now. For those new to the start-up terminology, a company that is valued at $1 billion is called a unicorn. Supposedly meant to compare with the rarest of rare sightings with the mythical animal. But unicorns aren’t that rare now. Mr. Natarajan says that at a count of 21, companies that turned Unicorns were less than half of the 44 seen in 2021.

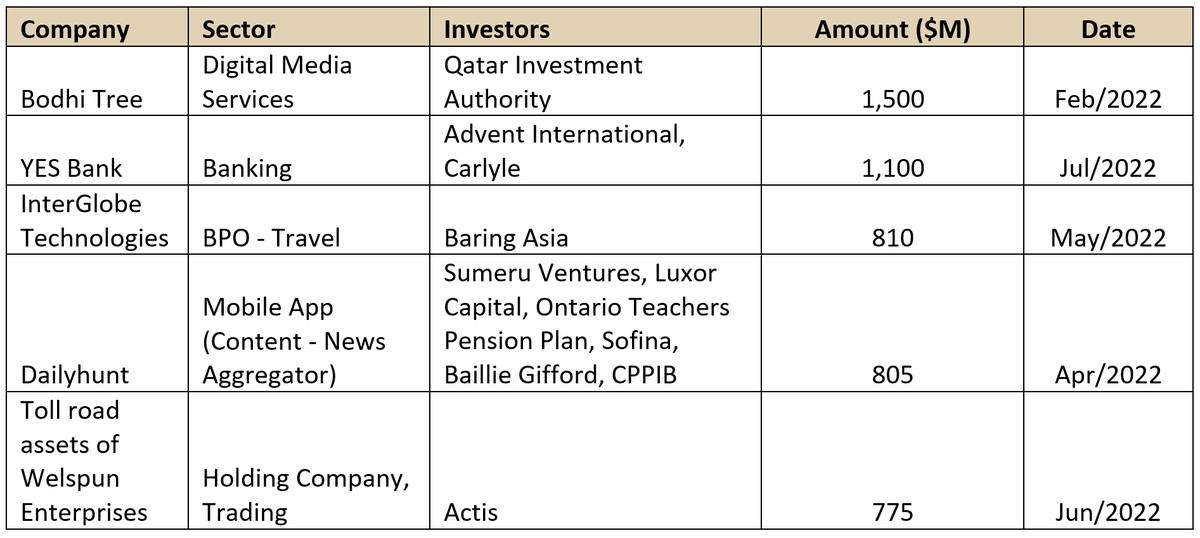

Where did funds flow in 2022?

Top PE-VC Investments in Startups in 2022

What’s ahead?

Mr. Natarajan concedes that there will be pain to face in the coming months, no doubt. The base effect will be seen come April and we will able to compared Jan-March 2023 vs that of 2022.

But he also says there are a few solid reasons why things are not as bad as to justify a panic situation. First, there is plentiful money that investors have raised and are waiting to invest in start-up firms.

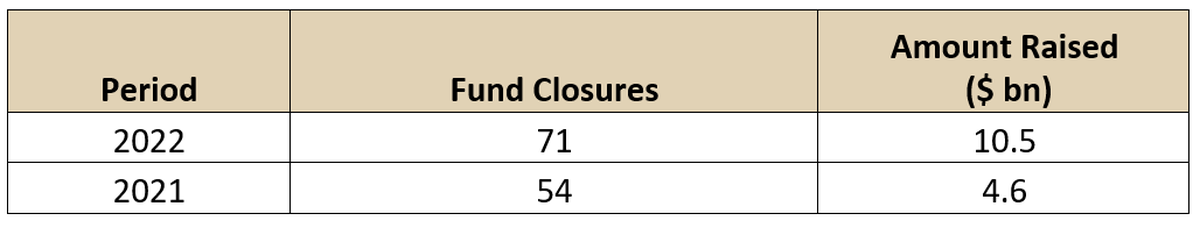

2021 has $4.6 bn marked against it while $10.5 bn is the sum raised by investor funds in 2022 and likely a good portion is still waiting to be invested.

Amount raised by PE/VC Firms

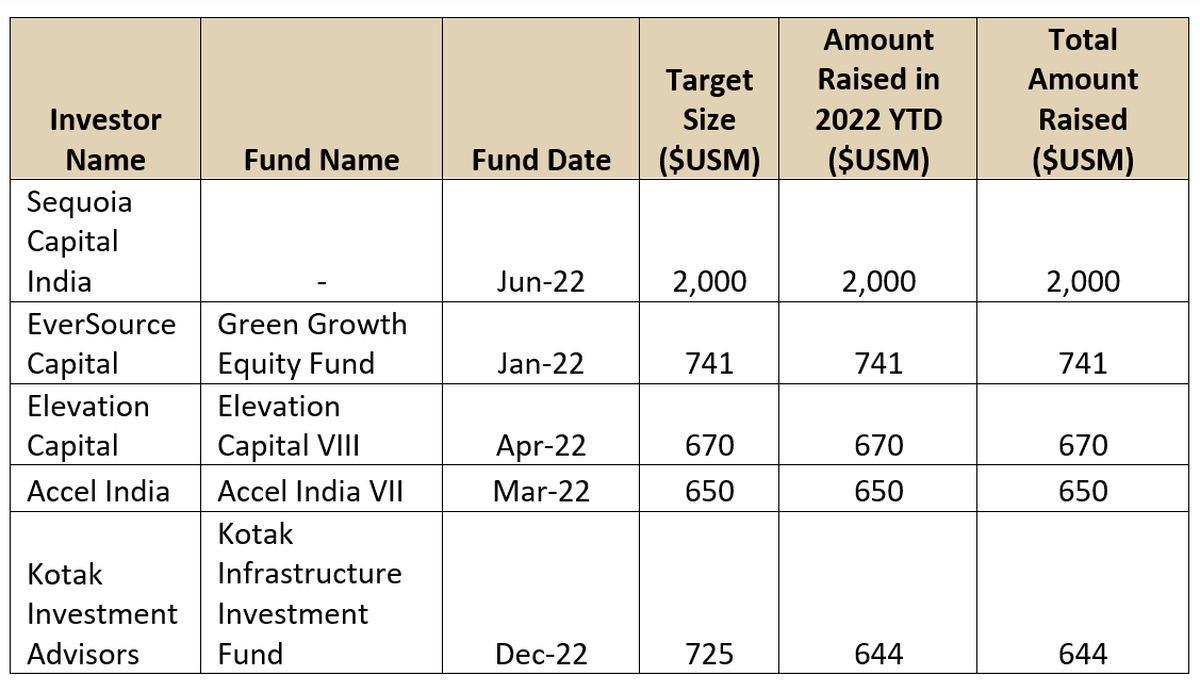

Here’s a list of names to give you an idea of which funds have raised how much.

How would 2023 be different?

The difference now would be that one round followed by another round in a few months may not happen this year. The pace of investments would be slower and investors would certainly be more conservative.

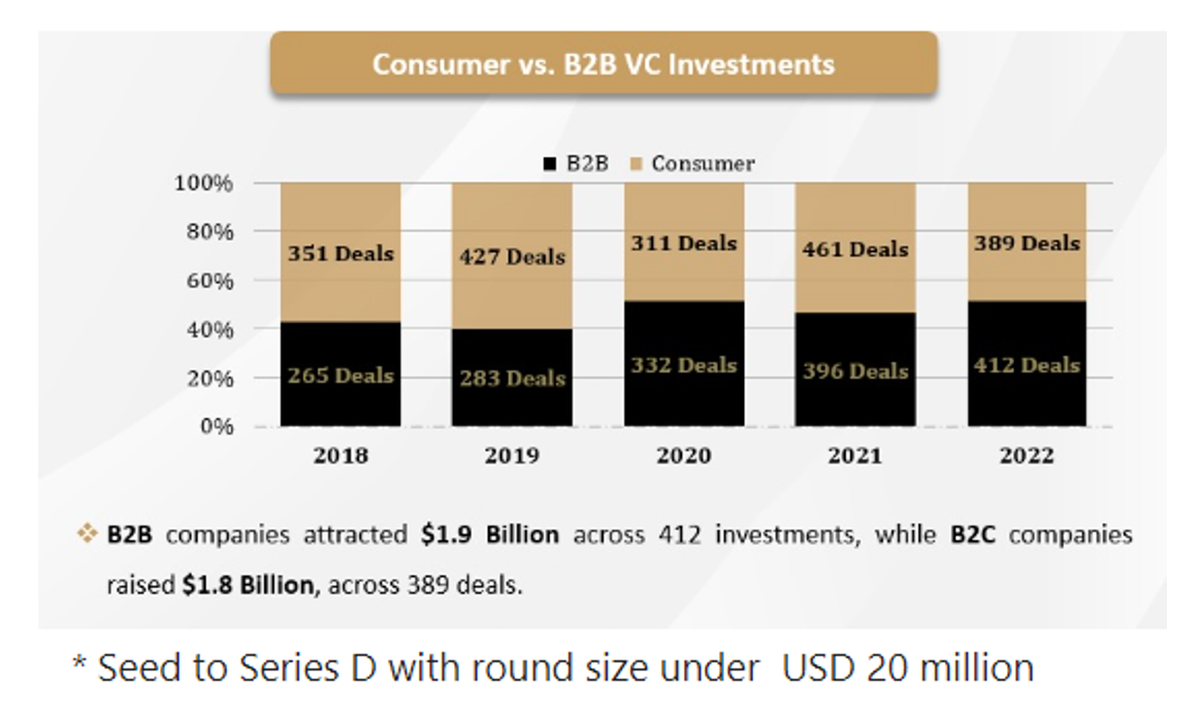

The second difference, as we mentioned, earlier is that the focus is now on B2B companies rather than B2C. B2C is when you sell your services to a company which in turn uses your services to likely to sell to an end user or consumer. You don’t directly sell to the end user. For example, if you sell rubber tyres to a car manufacturer, you are B2B while the carmaker is a B2C company. So, a software developer company with SaaS products targeted at online e-commerce firms, may seem more attractive to investors than the e-commerce firm itself. The trend of B2B as a preference started showing up in 2022, with 412 deals vs 389 in B2C. Compare this with 396 deals in B2B and 461 in consumer-oriented businesses. There some difference in quantum of funding, though minor – at 1.9 bn for B2B and $1.8 bn for B2C.

The third trend is that early-stage funding for new start-ups, as had already started in 2022, could come from founders and early employees of successful start-ups who have part-sold shares in their own funding rounds.

The final pattern to watch out for is the rise of specific sectors have earned the glad eye of investors – Biotech/Pharma sector and Deep Technology.

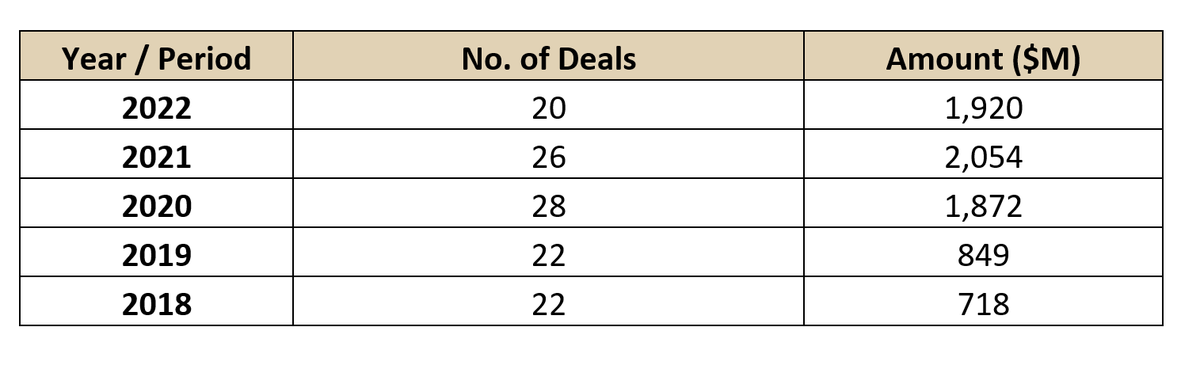

Here’s how investor interest in the biotech sector has grown. As with most other figures, 2022 was still higher than 2020, while 2021 acts as the outlier. Starting from 2018, it peaked in 2021 and dipped a bit in 2022. The 2022 figure of 1,920 mn is still higher than what was witnessed in 2020.

PE-VC Investments in Biotech & Pharma Sector

We can’t talk about start-ups in 2020-2022 without talking about EdTechs. Funding for this sector declined by 54% in 2022 compared with 2021 in value terms. In 2022, 50% of the funding was contributed by BYJU’S, which reportedly raised $915 million, followed by upGrad at $225 million. For a while now, companies in this sector have been receiving flak for poor services, abrupt layoffs of instructors, and even fraud… Even as the sector enjoying higher patronage from customers as the pandemic peaked, receding of the pandemic has also coincided with a dip in the sector’s fortunes. Time will tell how much steam is left in the arena here.

Script and presentation: K. Bharat Kumar

Production: Shibu Narayan

Videography: Johan Sathyadas