Chinese dodge censors to criticize falling stock market amid economic woes

With the internet tightly controlled in China and criticism of the economy or government quickly deleted, users are making their feelings known in unusual ways and through unexpected avenues.

An article by the official news agency Xinhua about the sport of diving had to be deleted on Tuesday after internet users started linking it to the behavior of Chinese stocks as shares hit multiyear lows in recent weeks.

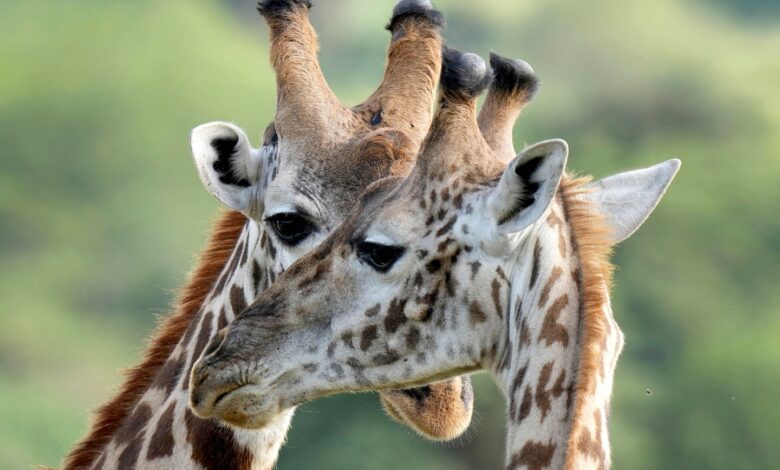

Users also flooded comments under a U.S. Embassy social media post about protecting giraffes in Africa with pleas that Chinese investors be allowed to become American citizens or if Washington could spare some missiles to bomb the Shanghai Stock Exchange.

As censors began deleting those comments, users turned to the Indian Embassy’s page, with one asking the question “How are you able to innovate and develop your stock market? Can you teach your neighboring country?”

The economy grew just 5.2 percent in 2023 — China’s slowest expansion in three decades, excluding the first three years of the pandemic. Economists say that one of the biggest impediments to recovery is a crisis of confidence among the public.

Chinese Premier Li Qiang last month pledged “forceful” measures would be taken to support the stock market. And state media has been awash with positive reports ahead of China’s Lunar New Year holiday about how the economy is “improving in an all-around way,” from new infrastructure to the appearance of rare animals in nature reserves.

While shares rebounded on Tuesday, authorities are still struggling to restore overall confidence. China’s benchmark index the Shanghai Composite closed 3.2 percent higher on Tuesday after six days of losses, while Hong Kong’s Hang Seng Index rose 4 percent.

When an article in the official People’s Daily claimed last week that “the entire country is filled with optimism,” it was roundly mocked. “The entire giraffe community is filled with optimism,” one commenter retorted.

Internet user on Weibo wishing everyone a happy year of the dragon using the names of companies whose stock prices have fallen more than 7% in recent days. pic.twitter.com/07gJaUwLcT

— Lily Kuo (@lilkuo) February 6, 2024

In January, a question posted in the Zhihu online forum asked citizens what developments have given them a sense of China’s “political progress” since 2010 to today. The post was soon deleted after comments pointing out various setbacks, including the falling prices of houses and stocks.

“Both were once so expensive, but now they’re quite cheap — and it seems they’re going to keep falling. At this rate, more people will be able to afford them,” one user wrote, according to China Digital Times, which tracks online censorship in China.

On Tuesday, Chinese President Xi Jinping was set to meet financial regulators to discuss the stock market situation, according to Bloomberg. The China Securities Regulatory Commission, meanwhile, vowed to prevent “abnormal fluctuations” in the stock market and to show “zero tolerance” to those who engage in “malicious short selling.”

Yet a key obstacle to repairing confidence may be the government’s own attempts to stifle negative commentary. China’s Ministry of State Security in December warned the public against those trying to “denigrate the Chinese economy.” Analysis by economists and financial bloggers soon began disappearing from the internet.

Reports this week about the state of the Chinese stocks have been glowing. A survey by a think tank under NetEase, a Chinese internet company, reported that nearly 70 percent of 60 economists were “optimistic” about Chinese shares on the Shanghai or Shenzhen stock exchanges in 2024, and more than 80 percent believe the market will not decline.

“People aren’t stupid,” a financial blogger under the username Liu Jinghua wrote on Weibo in response to such positive news. “In this era, the ability to obtain information is what is most indispensable. Word games won’t inspire confidence in anyone.”

Pei-Lin Wu in Taipei contributed to this report.