Venture funding for startups going strong

While the Covid-19 pandemic has negatively impacted investment and economic activities, venture funding for the country’s startups has bucked the trend and witnessed robust growth during Jan-Aug period of the current year.

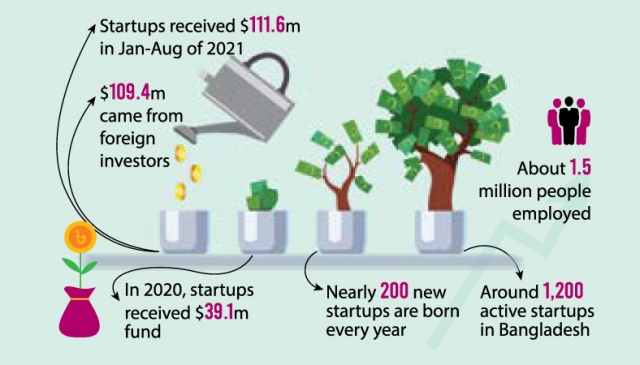

According to LightCastle Partners research, Bangladeshi startups received $111.6 million in investment during the January-August period of 2021.

Foreigner investors invested $109.4 million or about 98 per cent of the amount and the rest, $2.2 million, came from local investors.

In 2020, startups received a total of $39.1 million.

In the last five years, Bangladeshi startups attracted $272 million in investment, which was $330 million in the previous decade.

During the January-August period of 2021, ShopUp, a one-stop solution for SMEs in the country, raised $75 million fund, the highest as single startup, as series B financing, which was led by Peter Thiel’s Valar Ventures.

Besides, Paperfly received $11.80 million, Frontier Nutrition Inc $6 million, Praava Health $5.6 million, Truck Lagbe $3 million, Databird $3 million, Maya $2.16 million, alice $5,00,000, Intelligent Machine $4,70,000, Shuttle $4,00,000, Arogga $2,00,000, Shikho $1,00,000 and UPSKIL $11,0,000 in investment.

Fintech, ride-sharing and logistics are the most promising sectors to invest in, while digital marketing showed a drop in confidence due to market saturation and thinning profit margin.

Available data from LightCastle put the number of active startups in Bangladesh at around 1,200, while nearly 200 new startups spring up every year. These startups created about 1.5 million direct and indirect employments so far.

“Till now, Bangladesh startups have raised over $300 million in the last decade. In the first half of 2021, more than $35.6 million was invested by the local and global angel and venture capital institutions along with the support of the government-backed venture capital (VC), Startup Bangladesh Limited,” Mehad ul Haque, project manager and senior business consultant at LightCastle Partners, told The Business Post.

As the impact of the pandemic eases on economic activities, it is expected that the startups will be able to raise further investments, hopefully above $150 million, by the end of this year, said Haque.

Why are funds important for startups?

Startup entrepreneurs usually start a business with small savings or collecting funds from family members and friends.

Seed funding or venture capital is crucial for business expansion or to run day-to-day operations smoothly.

“The frame of the global economy has changed. Business people are focusing on production segmentation. As a result, a company does not need to be bigger or produce all the things. Now, it is a shared economy,” Mohammad Oli Ahad, managing director of startup Intelligent Machine, told The Business Post.

Intelligent Machine received $4,70,000 in seed funds.

Now, a small innovation is turning into a giant. That is why big investors are funding startups, said Ahad.

“Collecting or raising funds is not a goal of a startup. The goal is to chase the target they want to achieve. The necessity for funds emerges when a startup wants to take its work to the next level.”

A startup moves for funds when it cannot meet the expenses with the revenue earned from clients and needs to expand capacity to execute rising demands of their services, explained Ahad.

New funds taken from different investors are aimed at business expansion.

“We started business in 2016 to take delivery service to doorstep through smart logistic service. With steady growth in the e-commerce business, the volume of delivery orders went up and we were planning to improve infrastructure and capacity,” Rahath Ahmed, co-founder and chief marketing officer of Paperfly, told The Business Post.

Fund was very crucial for us for expanding our capacity and we received an investment from foreign investors, said Rahat.

Paperfly managed to attract an investment of $11.8 million from Ecom Express, an Indian technology-enabled end-to-end e-commerce logistics solutions provider.

With the new investment, we are expanding our network equipped with all facilities to deliver orders anywhere in the country regardless of size, he added.

While pouring funds on a startup, investors consider the innovativeness of the business ideas and business prospects. In addition, they also check business starting procedures and legal aspects of the entity, he added.

“We are working on attaining the sustainable development goals (SDGs) by providing services to safe transportation,” Jawad Jahangir, chief operating officer of Shuttle, told The Business Post.

Shuttle is a startup based in the capital that provides an app-based ride-sharing service. It received $4,00,000 in seed fund.

At the growth stage, the new fund is critical and our motto is to go for expansion to widen our networks, he added.

How to attract investors

Bangladesh is far behind in tapping opportunities to attract global funds for startups. Next-door countries like India and Pakistan are doing far better than us.

“In Bangladesh, investors are still giving importance to money than innovation and talent of an entrepreneur. That is why they are not coming with investment for startups,” said Ahad.

On the other hand, our network or connection with the investors is weak. Venture fund managers, as well as the startups, have to widen their networks, he added.

“In attracting investment, the government should exempt tax on venture capital and the tax waiver for the ICT sector should extend until 2030,” AKM Fahim Masroor, chief executive officer and co-founder of Bdjobs.com.

On the other hand, barriers to funding startups should be removed, said Fahim, also a former president of BASIS.

Why is local funding crucial?

“In Bangladesh, both startups and investment in startups rose in recent time. But compared to neighbouring countries like India and Pakistan, we are far behind in taping the opportunity,” Shameem Ahsan, chairman of Venture Capital and Private Equity Association of Bangladesh (VCPEAB), told The Business Post.

If we cannot come up with investments for the startups, then foreign investors will take most of the profits earned by our young entrepreneurs, Shameem added.

Citing the success of bKash, Shameem urged the local giant companies and investors to finance startups for entrepreneurship development.

Startups, which become successful, succeeded due to venture funding. This is because the investors nurture and mentor the startup after pouring funds into it, he added. In attracting more seed funds and venture capital, the government should continue tax exemption and wave duty.